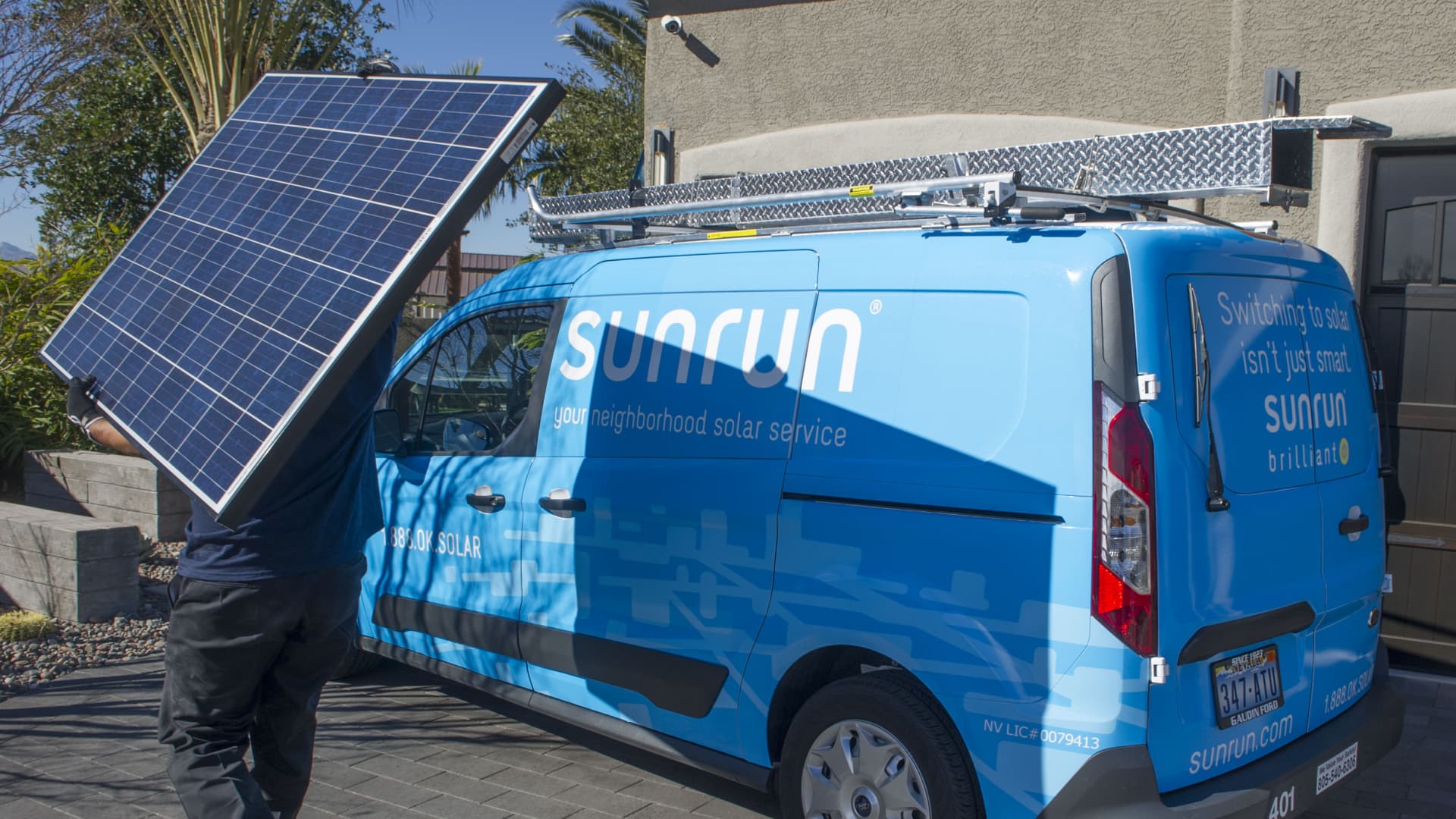

Here are Wednesday’s biggest calls on Wall Street: Mizuho upgrades Corning to outperform from neutral Mizuho said investors should buy the dip in the glass company. “We are upgrading Corning Incorporated (GLW) to Outperform ahead of the upcoming Sept 19 review of its Optical glass fiber business and following the recent pullback in the stock, as we’re aware of no overall slowdown in the company’s business and growth programs.” Raymond James reiterates Nvidia as strong buy Raymond James said it’s bullish heading into Nvidia earnings next week. “We are looking for another strong quarter from NVDA despite the noise surrounding Blackwell delays.” Citi upgrades Texas Instruments to buy from neutral Citi said that the company is on its way to “100% EPS growth.” “As such, we are upgrading TXN from Neutral to Buy as we believe margins are bottoming and should rebound back to the previous peak, which would result in 100% EPS growth.” Morgan Stanley reiterates Sunrun as overweight Morgan Stanley raised its price target on the stock to $35 per share from $31. ” RUN remains our preferred play in the distributed solar market.” Bank of America reiterates CrowdStrike as buy The firm is standing by the stock heading into earnings next week. ” CrowdStrike is scheduled to report 2Q earnings on 8/28, marking the first public commentary since the software incident that sparked a global IT outage on July 19th.” Wells Fargo resumes Keysight Technologies as overweight Wells said it’s bullish on shares of the manufacturer of electronics test and measurement equipment software. “With solid F3Q24 results + F4Q24 guide upside, we resume coverage on KEYS w/ OW rating and $180 PT.” Deutsche Bank reiterates Marvell as buy Deutsche said it’s bullish on shares of Marvell heading into earnings next week. “Maintaining secular momentum, waiting on cyclical swing.” Morgan Stanley reiterates Apple as overweight The firm said Apple is a top pick. ” Apple Intelligence Upgrade Cycle Undervalued By Market; Top Pick.” Wells Fargo downgrades Sonoco to underweight from equal weight Wells sees too much uncertainty for the packaging company. “As such, we d/g SON to UW and lower our PT to $52. Our FY24/25 EPS moves to 5.07/$5.90.” KeyBanc reiterates Netflix as overweight KeyBanc is sticking with the stock after the company’s upfront presentation to advertisers. ” Netflix had a successful second year of Upfront negotiations, with a > 150% increase in upfront ad sales commitments vs. 2023.” Jefferies upgrades BrightView to buy from hold Jefferies said the commercial landscape company is well positioned. “We’re upgrading BV to Buy from Hold as we expect revenue growth to return to LSD% [low single digits] and margins to reach new records.” BTIG upgrades Consensus Cloud Solutions to buy from neutral BTIG said the digital fax provider has “good margins and cash flow,.” “We are upgrading CCSI to Buy from Neutral.” Bank of America downgrades American Express to neutral from buy Bank of America downgraded the stock on valuation. “We downgrade American Express (AXP) to Neutral from Buy as we see limited incremental upside given potential for subdued billings volume growth and current premium valuation.” Cantor Fitzgerald initiates MicroStrategy as overweight Cantor said it’s bullish on shares of the bitcoin business intelligence company. “MicroStrategy is technically a provider of business intelligence and analytics software; however, the value in the business, in our view, lies in its ability to cost effectively accumulate Bitcoin.” Bernstein reiterates Tesla as underperform Bernstein said it’s sticking with its underperform rating on the stock. “Tesla (UP) has seen price cuts and falling lead times across markets, with near zero lead times and significant inventory in the US.” Citi opens a positive catalyst watch on Gap Citi said it’s bullish heading into Gap earnings on August 29. “We anticipate a big 2Q EPS beat (AMC 8/29) of $0.50, driven by stronger GM [gross margins] and slightly stronger sales vs cons.” MoffettNathanson reiterates Amazon as buy The firm said it’s sticking with its buy rating on the e-commerce giant. “We continue to see Amazon as the best positioned ecommerce player with the largest inventory offering and unrivaled fulfillment network offering global scale.” Raymond James downgrades Chewy to market perform from outperform Raymond James downgraded the online pet food company mainly on valuation. “We lower our rating on CHWY to Market Perform from Outperform following the stock’s > 50%increase over the past three months, and exceeding our $24 price target.” Bank of America upgrades California Resources to buy from neutral Bank of America said the carbon energy company and Occidental Petroleum spinoff is “uniquely positioned.” “As the only public CA E & P with a powerplant, CRC is uniquely positioned to potentially participate in the states data center build out.”

Wednesday’s top Wall Street stocks to watch

Related Posts

RECENT POSTS

Browse by Category

- Books (1)

- Business (3,597)

- Events (2)

- Fashion (5,633)

- Horror (1)

- Interviews (28)

- Movies (5,629)

- Music (5,664)

- News & Gossip (6,310)

- Television (5,662)

- Uncategorized (1)

- Video Of The Day (914)

READERS' PICKS

EDITOR'S PICKS

© 2022 EssentiallyHollywood.com - All Rights Reserved

![Mason Ramsey – Twang [Official Music Video] Mason Ramsey – Twang [Official Music Video]](https://i.ytimg.com/vi/xwe8F_AhLY0/maxresdefault.jpg)