The White House has asked South Korea to urge its chipmakers not to fill any market gap in China if Beijing bans Idaho-based Micron from selling chips, as it tries to rally allies to counter Chinese economic coercion.

The US made the request as President Yoon Suk-yeol prepares to travel to Washington for a state visit on Monday, according to four people familiar with the talks between the White House and presidential office in Seoul.

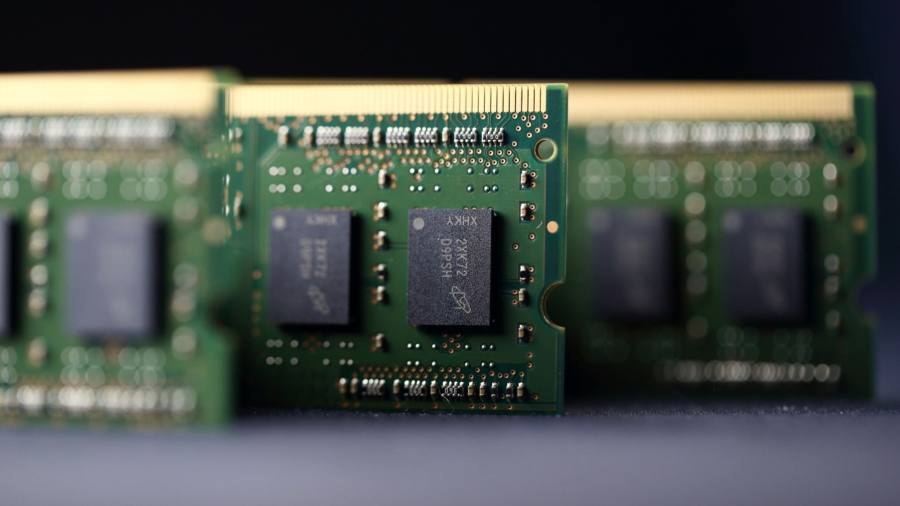

China this month launched a national security review into Micron, one of the three dominant players in the global Dram memory chip market, with South Korea’s Samsung Electronics and SK Hynix.

It is unclear if the Cyberspace Administration of China will take punitive action after its probe. But the stakes are high for Micron as mainland China and Hong Kong generated 25 per cent of its $30.8bn in revenue last year.

US officials and business executives believe the CAC probe is Beijing’s retaliation against the tough actions that President Joe Biden has taken to help prevent China from obtaining or producing advanced semiconductors.

The Micron case has emerged as a litmus test of whether Beijing is willing to take coercive economic measures against a major US company for the first time.

The US has asked Seoul to encourage Samsung Electronics and SK Hynix to hold back from boosting sales to China if Micron is banned from selling as a result of the investigation, according to people familiar with the situation.

The White House’s request comes at a sensitive time with Yoon arriving in Washington on Monday. While the US has worked with allies to counter China in the security area in the Indo-Pacific, this is the first known occasion that it has asked an ally to enlist its companies to play a role.

The South Korean embassy in Washington and Samsung did not respond to requests for comment. SK Hynix said it had not received a request from the South Korean government. Micron declined to comment.

The White House did not comment on specifics, but said the Biden and Yoon administrations had made “historic progress” deepening co-operation on national and economic security issues, including efforts to protect “leading-edge technologies”.

“This includes efforts to co-ordinate investments in the semiconductor sector, secure critical technologies, and address economic coercion,” said the US National Security Council. “We expect the upcoming state visit to even further strengthen co-operation on all these fronts.”

It is unclear how Seoul has responded. US and South Korean officials are finalising the visit. They are discussing many issues, including how the US can give Seoul more assurance about “extended deterrence” — the US nuclear umbrella — as North Korea ratchets up tensions on the peninsula.

The Micron-related request puts Yoon in a complicated position. He took office last year on a platform widely regarded as more hawkish on China than that of his left-leaning predecessor, Moon Jae-in. Illustrating his stance, he provoked an angry response from Beijing last week by accusing China of attempting to change the status quo over Taiwan “by force”.

But his administration has also chafed at US efforts to rally allies behind its economic security agenda, amid fears that the long-term competitiveness of Samsung and SK Hynix could be undermined by US export controls.

While Samsung and SK Hynix will not welcome efforts to curtail their business in China, the US may have some leverage. When the US unveiled sweeping chip-related export controls on China last October, it gave South Korean companies with chip fabrication facilities in China waivers to allow them to export from the country. Those waivers must be renewed later this year. The commerce department said it had no update on the situation.

Memory chip manufacturers are already under pressure due to an industry glut that in the first quarter of this year triggered a 25 per cent decline in the price of Dram chips, which are used in everything from TVs to phones.

Last week, Treasury secretary Janet Yellen said Washington was concerned about “a recent uptick in coercive actions targeting US firms”.

One person familiar with the situation said the request to Seoul reflects the fact that the Biden team was “motivated to ensure that China is not going to be able to use Micron as a lever to influence or effect US policy”.

He said the US could help stymie Chinese efforts at economic coercion by showing Beijing that it would work with allies and partners to undermine any such move against American or allied companies.

China has used economic coercion against Taiwan and other countries including Lithuania and Australia. But it has refrained from taking major action against the US even as Biden has unveiled tough chip export controls and imposed sanctions on other Chinese companies.

One person who recently met Chinese officials in Beijing said they were losing patience at what they saw as US efforts to crack down on Chinese companies, suggesting that it was considering retaliation.

The US request to Seoul underscores how chips are at the heart of some of the deepest faultlines between Washington and Beijing.

In December, the US put Yangtze Memory Technologies Co, a memory chip producer the White House has called a Chinese “national champion”, on its “entity list”. That means companies are barred from exporting American technology to the nascent Micron rival without a hard-to-obtain licence.

Follow Demetri Sevastopulo on Twitter

![Mason Ramsey – Twang [Official Music Video] Mason Ramsey – Twang [Official Music Video]](https://i.ytimg.com/vi/xwe8F_AhLY0/maxresdefault.jpg)