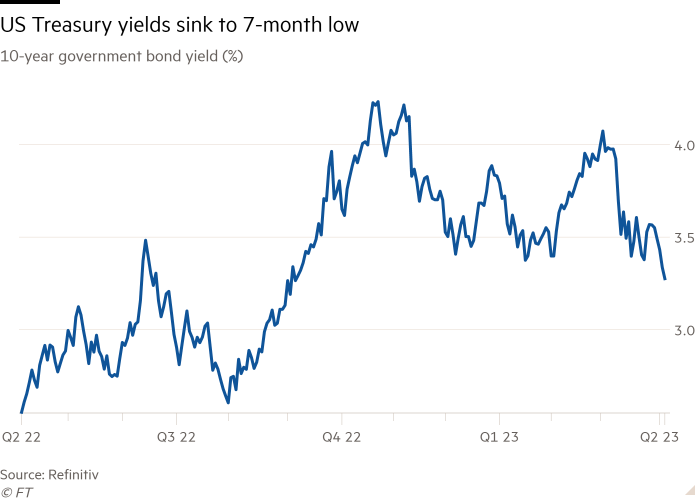

US government debt rallied on Wednesday, pushing Treasury yields to their lowest level in seven months, after investors digested weaker than expected reports on the US labour market and services sector.

Yields on two-year Treasuries, which are more sensitive to monetary policy, and 10-year Treasuries both fell 0.04 percentage points to 3.29 per cent and 3.7 per cent, respectively, moderating from gains earlier in the session.

Equities slipped in afternoon trading in New York, with the blue-chip S&P 500 losing 0.4 per cent, as investors appeared to eschew growth stocks for more defensive sectors, which tend to be more resilient in a downturn. Utilities rose 2.6 per cent, healthcare gained 1.8 per cent and consumer staples were up 0.7 per cent, meanwhile the tech sector fell 1.5 per cent. The Nasdaq Composite declined 1.2 per cent.

The moves followed a duo of soft economic reports that added to signs the US economy and labour market are losing momentum.

Payroll processor ADP said private businesses in the US created 145,000 jobs in March, below forecasts of 200,000. A separate report from the Institute for Supply Management showed the vast services sector cooling last month, with a deceleration in its employment sub-index.

Earlier this week the labour department said job openings in the US fell in February to the lowest level in nearly two years.

The latest data suggests the tight US labour market, which has been a major factor fuelling high inflation, is beginning to show signs of slack.

Bill Adams, chief economist at Comerica Bank, said: “The labour market is getting less tight. This is one of the Fed’s conditions for pausing its interest rate hiking campaign, but the Fed also wants to see core inflation slow more.”

Analysts are looking to the more influential non-farm payrolls figures on Friday to provide further clarity. Investors now see a better than even chance that the Fed will hold interest rates at its next meeting in May, although markets are still pricing in a moderate chance of a quarter percentage point rise.

“The story of the past few months has been the labour market holding up,” said Andrew Hunter, deputy chief US economist at Capital Economics “We do think a sharper slowdown is coming, it’s just a question of when.”

US bank stocks also fell as investors remain on edge over the fallout from the recent banking crisis. The KBW bank index, which tracks 22 US banks, lost 0.8 per cent following Tuesday’s losses, which came after JPMorgan chief executive Jamie Dimon warned the crisis was “not yet over” and its effects would be felt for “years to come”.

Emmanuel Cau, head of European equity strategy at Barclays, said: “So far the contagion has been contained but I think we lack perspective on the broader ramifications of the end of easy money and higher interest rates. There may be pockets of instability.”

European stocks also lost ground on Wednesday. The region-wide Stoxx 600 fell 0.2 per cent, while Germany’s Dax lost 0.5 per cent and France’s CAC 40 slipped 0.4 per cent. London’s FTSE 100 rose 0.3 per cent.

In Asia, the Hang Seng index closed down 0.7 per cent while China’s CSI 300 gained 0.3 per cent.

The dollar index, which measures the greenback against a basket of six peer currencies, rose 0.2 per cent. Gold was flat at 2,020.26 an ounce, its highest level since March 2022.

![Mason Ramsey – Twang [Official Music Video] Mason Ramsey – Twang [Official Music Video]](https://i.ytimg.com/vi/xwe8F_AhLY0/maxresdefault.jpg)