US stocks erased earlier gains after two Federal Reserve members said they expected the policy rate to surpass 5 per cent in 2023, curbing investors’ hopes for less restrictive monetary policy.

Wall Street’s blue-chip S&P 500, which had been up as much as 1.4 per cent earlier on Monday, closed 0.1 per cent lower on Monday, with pharmaceutical stocks featuring among the decliners. The tech-heavy Nasdaq Composite, at one point up almost 2.3 per cent, finished 0.6 per cent higher, with Tesla and chipmakers Nvidia and Advanced Micro Devices rising more than 5 per cent.

Both indices pared gains in afternoon trading following comments from the presidents of the US central bank’s San Francisco and Atlanta branches that the fed funds rate would need to surpass 5 per cent in order slow down inflation. Atlanta Fed president Raphael Bostic said the rate should hold above that watermark for “a long time”.

The hawkish comments on Monday contrast with the dovish signal traders inferred from US government data on Friday that showed employees’ average hourly earnings rose 4.6 per cent year on year on a seasonally adjusted basis in December, compared with 4.8 per cent the previous month, easing the upward pressure on inflation. The world’s biggest economy added 223,000 jobs in the final month of 2022 — more than economists had expected but smaller than the 256,000 increase in November.

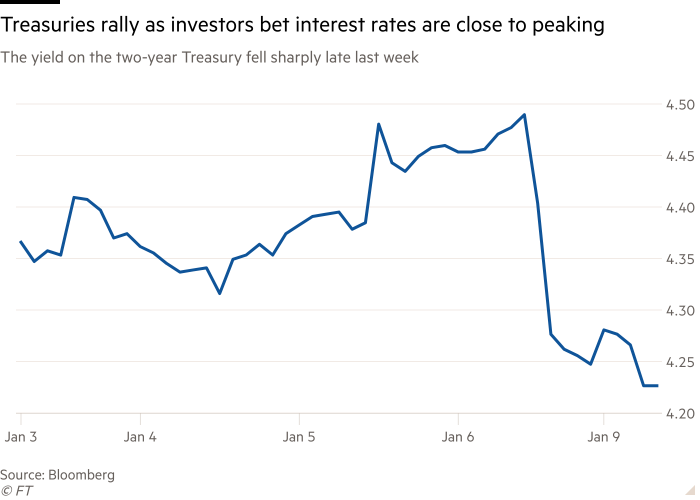

Government bonds rallied as a result, with the yield on the two-year Treasury note, which is sensitive to interest rate expectations, falling almost a quarter of a percentage point. On Monday, the yield on the note slipped a further 0.05 percentage points to 4.20 per cent. Bond yields move inversely to prices.

“The wage data was the story of Friday’s ‘everything rally’ in bonds and stocks,” said Charlie McElligott, equity derivatives strategist at Nomura, “because most see the [Fed] as requiring wage growth deceleration to accompany the disinflationary progress elsewhere in order to signal tangible progress towards their price-stability goals”.

The Fed last year lifted interest rates from near zero to between 4.25 per cent and 4.5 per cent. Rates markets are pricing in a roughly 75 per cent chance that the central bank will lift borrowing costs by a quarter of a percentage point when it meets at the end of January. US inflation data out on Thursday is expected to show prices rose 6.6 per cent year on year in December — down from an increase of 7.1 per cent in November. That would mark the slowest pace since October 2021. San Francisco Fed president Mary Daly on Monday backed the idea of a quarter-point raise at the end of the month.

An index tracking the dollar’s strength against a basket of six peers fell 0.7 per cent on Monday as traders continue to bet the Fed will raise rates at a slower clip in the first few months of 2023. The currency has weakened more than 8 per cent over the past three months.

“The US economy remains resilient but on a downtrend,” said Florian Ielpo, head of macro at Lombard Odier Asset Management. Even so, slowing inflation in Europe and China’s relaxation of strict zero-Covid policies meant that for “most risk-on asset classes, the direction has been the same — globally up”, he added.

Europe’s regional Stoxx 600 climbed 0.9 per cent, adding to last week’s 4.2 per cent gain, with technology and energy stocks among the top performers. London’s FTSE 100 rose 0.3 per cent.

Germany’s Dax gained 1.3 per cent after production in the country’s manufacturing, energy and construction sectors increased 0.2 per cent between October and November, boosting hopes of a milder-than-feared economic downturn across the single currency area.

Eurozone inflation fell back into single digits in December, with data published late last week showing the headline rate hitting 9.2 per cent after annual price growth exceeded 10 per cent for the previous two months.

Figures out on Monday showed unemployment in the region fell to a 24-year low in November, however, adding to pressure on the European Central Bank to keep raising rates.

In Asia, Hong Kong’s Hang Seng index gained 1.9 per cent and China’s CSI 300 index of stocks listed in Shanghai and Shenzhen rose 0.8 per cent.

Oil prices ticked higher, meanwhile, with Brent crude, the international oil benchmark, settling 1.4 per cent higher to $79.65 per barrel on expectations of higher demand. Prices of Dutch TTF, the benchmark European gas contract, rose as much as 9.9 per cent on Monday to €74.40 per megawatt hour.

![Mason Ramsey – Twang [Official Music Video] Mason Ramsey – Twang [Official Music Video]](https://i.ytimg.com/vi/xwe8F_AhLY0/maxresdefault.jpg)