Stay informed with free updates

Simply sign up to the US inflation myFT Digest — delivered directly to your inbox.

The measure of inflation preferred by US rate setters fell by more than expected in November, bolstering investor expectations of rate cuts next year.

The core personal consumption expenditures price index showed prices rose by 3.2 per cent last month, down from a revised figure of 3.4 per cent in the year to October, according to data from the Bureau of Economic Analysis.

The month-on-month increase in the core measure — which removes price changes for more volatile items such as food and energy, and is regarded as a better gauge of underlying price pressures — hit 0.1 per cent. That was on par with the revised October figure. Economists polled by Reuters expected a reading of 0.2 per cent for November.

The news pushed up US stocks, with the Wall Street benchmark S&P 500 share gauge adding 0.3 per cent in the first few minutes after the opening bell on Friday, edging closer to a fresh all-time high. The technology-heavy Nasdaq Composite rose 0.4 per cent. The indices have climbed 24 per cent and 44 per cent respectively in 2023.

US government bonds also rallied modestly on Friday following the release of the PCE report.

The headline figure in Friday’s report showed prices were falling, with a month-on-month reading of minus 0.1 per cent. However, this is not the measure most officials closely watch as it reflects changes in costs for goods such as fuel, where prices can swing more significantly. The price of energy goods and services was down 2.7 per cent month on month.

The headline measure also offers little indication of underlying price pressures in the vast services sector, which officials are watching for signs on how sticky this current bout of inflation will prove.

The November PCE figure is the latest piece of data to offer good news on price pressures, adding to hopes that the US Federal Reserve is winning an almost two-year long battle against inflation.

Annual headline PCE fell to 2.6 per cent from 2.9 per cent in October.

However, economists at Citi cautioned against an overly optimistic interpretation of the data, saying services sector inflation remained too high.

“Core inflation is weaker because of a major disinflation in goods. That may keep core readings softer in coming months but is not a sustainable way to return inflation to target,” said Andrew Hollenhorst, an economist at the bank.

“Declining prices are associated with a normalisation in supply chains that has fully played out. Disruptions to Red Sea trade are just one example of the increased upside risk to goods inflation post-pandemic.”

Fed officials expect to make three rate cuts next year, calling time on a series of rate rises that have left the federal funds target at a 22-year high of between 5.25 per cent and 5.5 per cent.

While officials have pushed back against market bets of cuts as soon as March, they appear confident that the US economy will secure a soft landing, with inflation expected to drift back to their 2 per cent goal with only a small rise in unemployment.

On Wall Street, the policy-sensitive two-year yield traded 0.02 percentage points lower at 4.33 per cent, while the 10-year yield slipped 0.04 percentages points lower to 3.89 per cent. Bond prices rise as yields fall.

Trading in the US government debt market will close early on Friday, at 2pm eastern time.

Dean Maki, chief economist at Point72, said investors had set themselves up “for a really weak” inflation report. “It did come in on the soft side, but maybe not as weak as some investors were expecting.”

Maki added: “With six rate cuts priced in, the market was set up for favourable inflation news.”

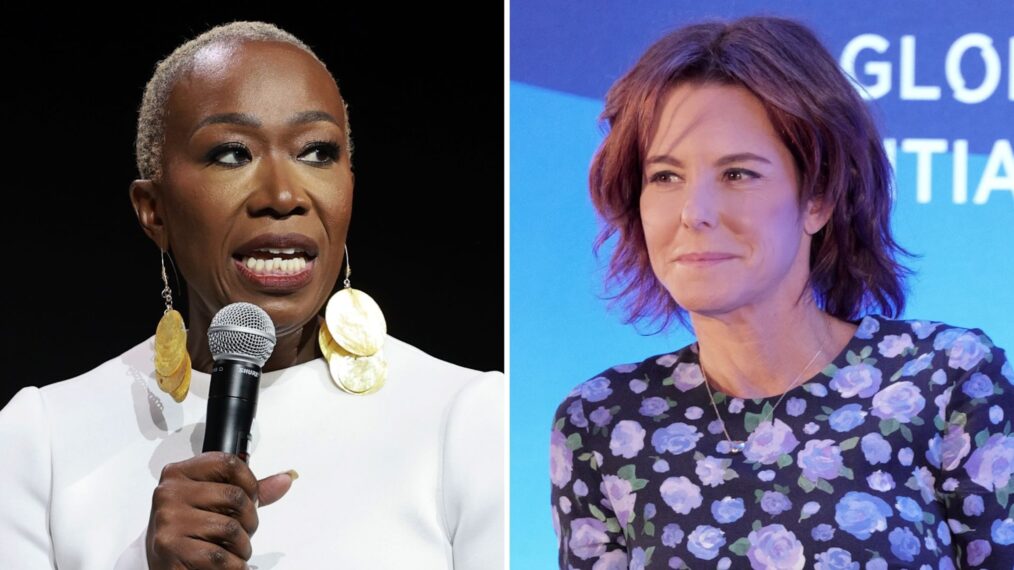

Additional reporting by Jennifer Hughes and Jaren Kerr

:quality(85):upscale()/2023/12/22/694/n/1922564/5e6f2e016585adbc1a1d69.44526394_.jpg)