Iovance Biotherapeutics ‘ star asset could propel its stock to new heights, according to Goldman Sachs. The investing firm initiated coverage of the biotech with a buy rating and a 12-month price target of $12. This implies upside of nearly 138% from Friday’s close. Shares of the biopharma company are down more than 12% this year, although they added nearly 8% on Monday. IOVA YTD mountain IOVA YTD chart Iovance specializes in developing autologous tumor-infiltrating lymphocyte, or TIL, therapies for solid tumor cancers using its lead asset lifileucel. As a catalyst, analyst Andrea Tan pointed to the upcoming approval of the company’s first such treatment, which is slated to be reviewed by February 2024. “With accelerated approval, lifileucel would be the first cell therapy approved for solid tumors and IOVA is preparing for commercial launch,” she wrote. The analyst added that lifileucel, a “best-in-class therapy,” has the potential to become the standard of care in treating melanoma. Tan is also optimistic that the therapy could be launched and adopted quickly. “The upcoming approval of the first TIL therapy will transition IOVA to a commercial company where we are constructive on the near- and long-term launch potential given lifileucel’s best-in-class profile, early signs of KOL enthusiasm, expected favorable pricing and coverage, and manufacturing readiness and capacity, all of which should support a blockbuster opportunity,” she added. The company also plans to expand into first-line trials to treat melanoma and non-small cell lung cancer and has undertaken efforts to explore TIL therapies to treat cervical and endometrial cancers. — CNBC’s Michael Bloom contributed to this report.

Under-the-radar biopharma stock could more than double, Goldman says

Related Posts

RECENT POSTS

Browse by Category

- Books (1)

- Business (3,597)

- Events (2)

- Fashion (5,634)

- Horror (1)

- Interviews (28)

- Movies (5,630)

- Music (5,665)

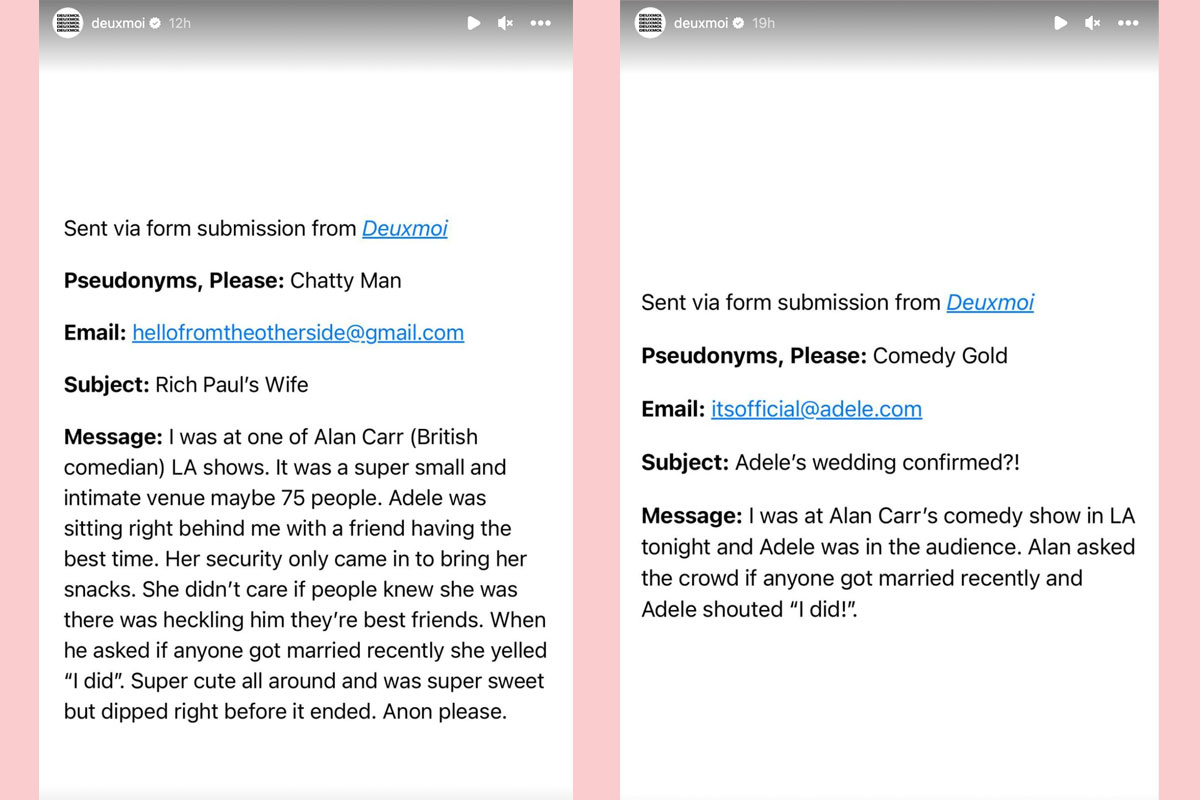

- News & Gossip (6,311)

- Television (5,663)

- Uncategorized (1)

- Video Of The Day (914)

POPULAR POSTS

READERS' PICKS

EDITOR'S PICKS

© 2022 EssentiallyHollywood.com - All Rights Reserved

![Mason Ramsey – Twang [Official Music Video] Mason Ramsey – Twang [Official Music Video]](https://i.ytimg.com/vi/xwe8F_AhLY0/maxresdefault.jpg)