A site close to Kruger National Park in South Africa is becoming a testing ground for US attempts to fight China’s global dominance in critical minerals.

Washington has committed to finance a little-known London-listed miner hoping to extract rare earths — a set of 17 minerals key to clean energy technologies — from the chalky stacks outside the safari park, as the US seeks to challenge China’s runaway lead in accessing the metals globally.

But a 63 per cent drop in rare earth prices since the start of 2022 has called into question the project’s ability to raise funding. The fate of the $300mn mine at Phalaborwa may echo that of others aiming to extract critical minerals for the west, and raises the question of whether US support is sufficient to build up a counterweight to Beijing.

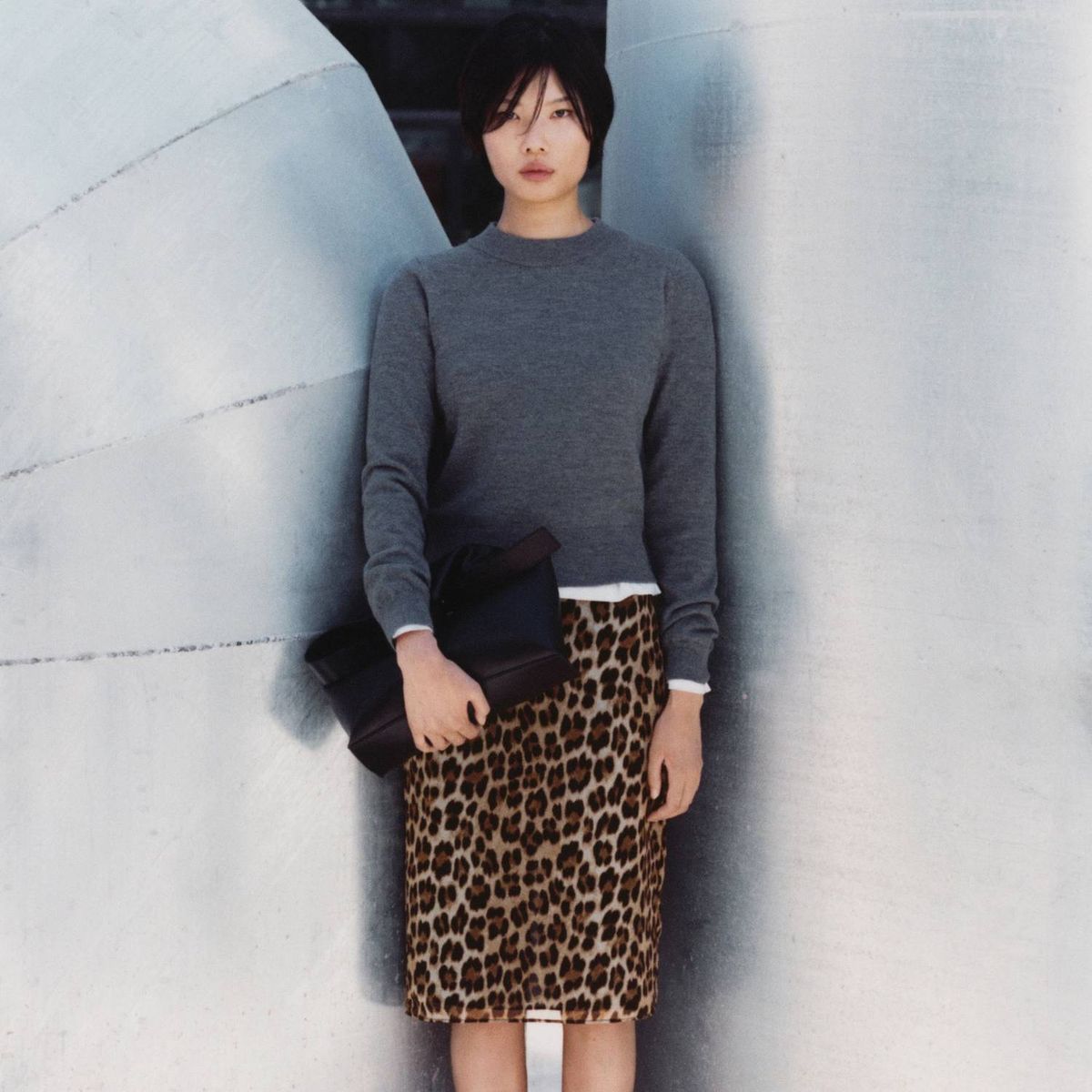

The project, whose site is visited by kudus, springboks and buffaloes, is close to completing a feasibility study on the economics of extracting minerals from gypsum waste generated by old phosphate mines — but it still needs to raise another $250mn.

“The question is ‘given the basket price for rare earths, does it make sense to move ahead?’,” said Andrew Breichmanas, analyst at Stifel.

For the White House, tackling Chinese dominance is a strategic priority: China is home to 70 per cent of rare earths mining and 90 per cent of processing capacity, according to the International Energy Agency.

That gives Beijing a near-monopoly on permanent magnets used in electric vehicles, wind turbines and fighter jets. China also controls the supply of other clean energy resources such as graphite, cobalt and nickel.

Washington has been seeking to invest in its own future supply. The US International Development Finance Corporation (DFC) has invested $105mn into TechMet, a $1bn critical minerals fund, which has pledged $50mn of equity for Rainbow Rare Earths, the company behind the mine, when it is ready to start raising finance to build the plant later this year.

Nisha Biswal, DFC deputy chief executive, said the state entity expected to increase investments in African critical minerals, with this year’s total likely to exceed last year’s $700mn. “This is just the start,” she added.

A key element of that is financing projects such as the Lobito Corridor railway to connect a port in Angola with copper mines in the region. And beyond the DFC, Washington is providing incentives for the construction of US processing plants through the Inflation Reduction Act.

Yet recent price slumps in lithium, cobalt, nickel and graphite — all ingredients in electric vehicle batteries — have prompted western producers to shut mines, cut production and reduce expansion plans. Among major miners, BHP is considering closing Nickel West in Western Australia; Albemarle, the world’s largest lithium producer, has cut back spending plans; and Glencore is reducing cobalt output.

Analysts say these projects are at risk from price fluctuations because western efforts to support the sector remain piecemeal and flawed against China’s multi-decade lead.

Chinese producers are often integrated with industrial activities or receive state-backed financing, enabling them to power ahead even in commodity downturns.

Rainbow Rare Earths argues projects such as its own will be crucial to western energy security. “Your green energy, wind turbines, electric cars, drones and handheld cell phones all have rare earth elements in them,” said George Bennett, chief executive. “Sources outside of China to give the west some kind of independence are very important.”

Amos Hochstein, the US government’s chief energy security adviser, said the future energy market could fall into similar traps to those seen with fossil fuels.

“My concern is that the worst of the 20th-century energy architecture will be repeated in the 21st century,” Hochstein said. “It would maybe be worse because, instead of a group of countries that control the supply, there’ll be a single point of failure or a single point of ability to manipulate global supply and prices.”

In particular, investors fear China may flood the rare earths market as it has done periodically since the 1980s. Beijing influences supply and prices through tax policies, quota systems and export restrictions, but denies exerting control to damage competitors.

Beijing’s foreign ministry said: “The so-called claim that China controls market prices through dumping and other means is completely unfounded. In the era of globalisation, the interests of various countries are deeply integrated.”

It added that global supply chains reflected the “functioning of economic laws” while China “always adheres to the principles of openness, co-ordination, and sharing, playing a positive role in the security and stability of the global critical mineral resources production and supply chain”.

Still, prices have been volatile. Prices for neodymium-praseodymium oxide, a compound of two of the most important rare earths for permanent magnets — for which China is both the largest supplier and consumer — are hovering just above $53,000 per tonne, after hitting the lowest level in more than three years in March, according to Argus, a data provider.

Such pricing “seriously jeopardises non-Chinese producers and exploration projects”, said Ellie Saklatvala, head of non-ferrous pricing at Argus.

Rainbow’s Bennett argues Washington needs to consider stockpiling rare earths and other critical minerals by guaranteeing a minimum price for producers through long-term supply contracts. He would be willing to sign such a deal despite it also placing a ceiling on the prices that the mine could receive.

Some other western miners have secured supply purchase deals with companies: Australia’s Lynas, which received concessional financing from Japanese government entities, reached one with Japan’s Sojitz conglomerate, while MP Materials in the US signed a deal with General Motors.

This month Gina Rinehart, Australia’s richest person, revealed she had taken minority stakes in Lynas and MP Materials, fuelling speculation that merger talks between the two largest rare earth groups outside China, which ended in February, could be rekindled.

Stifel’s Breichmanas said the Phalaborwa project “warrants” development but “supply purchase agreements are going to be really, really important”.

“The US government needs to become the buyer of last resort,” said Bennett. “It’s a chicken and egg [problem]. You can’t build [manufacturing] capability because you don’t have reliable supply. You can’t create a reliable supply unless you’ve got a buyer of it.”

That would also solve another strategic problem for the US, Bennett said. The country has no rare earth alloy producers or magnet manufacturers, but any downstream producers would need reliable supplies of affordable material to secure their own funding.

For its part, Beijing is no stranger to stockpiling during market gluts, making record purchases of cobalt last year for its strategic reserve.

The US Department of Defense stores critical minerals in the National Defense Stockpile, but its value has dropped from $9bn in 1989 to less than $1bn, or below 0.3 per cent of annual demand globally, as of March 2023.

“For the American and European supply chains to be built, you need a surety built by the government,” said Matthew Ashley, senior cobalt trader at Traxys, a Luxembourg-based trading house.

Brian Menell, chief executive of TechMet, said that despite the efforts of funds like his, “the problem of future shortages and Chinese control is growing day by day”.

He added: “It’s the product of manipulation and the short-term view of western markets.”

Additional reporting by Wenjie Ding