Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Proxy adviser ISS has counselled Tesla shareholders to vote against Elon Musk’s $56bn pay award but supported a proposal to reincorporate the electric-car maker in Texas, in a mixed result for the board ahead of its annual meeting next month.

“Although the achievement of the grant’s performance hurdles and the substantial growth in the company’s size and profitability are fully recognised, the award value was considered outsized from the start,” ISS said in a report on Thursday.

The advice echoes that of proxy peer Glass Lewis, which said the chief executive’s package of share options — the largest in US corporate history — was an “excessive size” last week.

Tesla’s board has been lobbying investors to re-ratify Musk’s $56bn award given in 2018, which was voided by a Delaware judge in January due to concerns over the board’s transparency and independence. The judgment prompted Musk to demand the company leave the state.

ISS disagreed with Glass Lewis over the risks of moving to Texas from Delaware, offering “cautious” support. While conceding “the process undertaken by the board to reach a decision . . . does leave something to be desired” and that “Texas business courts are new and have no robust body of legal case law precedents”, ISS concluded “it is not readily apparent that the rights of shareholders would be materially harmed”.

Proxy advisers’ recommendations are significant because they sway the decisions of institutional investors such as Vanguard, Capital Group, Norges and State Street, all among the top 10 shareholders in Tesla and which voted against the pay proposal in 2018. Even though ISS and Glass Lewis also opposed the pay award then, it passed with 73 per cent approval.

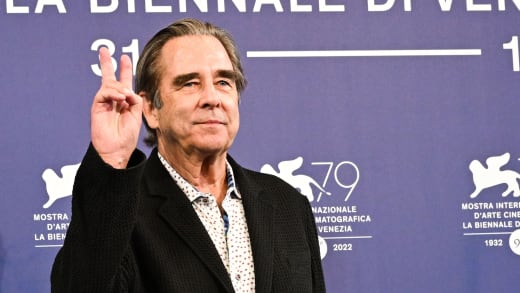

Tesla chair Robyn Denholm has led the campaign to win support for both proposals, countering that Musk draws no salary for his role and is entitled to the money after hitting ambitious targets for revenue and stock price. She brushed off criticism that she and other directors were too close to the chief executive as “crap” and “total BS”.

While winning the pay vote would not overturn Delaware’s decision, the carmaker believes proof that shareholders still approve of the award could be decisive in subsequent legal appeals.

If Tesla is successful on June 13, Musk’s stake in the company will increase to more than 20 per cent from 13 per cent. A loss would damage the credibility of Denholm and the rest of the board and raise questions about Musk’s future at Tesla.

The tech billionaire has threatened to develop artificial intelligence products elsewhere if he does not gain greater control of the carmaker, which he is repositioning as an AI and robotics company.

Tesla also has to persuade thousands of retail investors around the world to vote in favour of the resolutions. They account for about 30 per cent of shares, an unusually high amount for a listed company, and will be crucial in the outcome.

On the pay vote, a simple majority must be in favour, excluding shares owned by Musk and his brother Kimbal. Reincorporation in Texas has a higher bar, requiring a majority of all shares outstanding, because those not cast are counted as a “no”.

ISS also urged investors not to approve the re-election of former 21st Century Fox chief James Murdoch to the board.

![Bruno Mars, Anderson .Paak, Silk Sonic – Smokin Out The Window [Official Music Video] Bruno Mars, Anderson .Paak, Silk Sonic – Smokin Out The Window [Official Music Video]](https://i.ytimg.com/vi/GG7fLOmlhYg/maxresdefault.jpg)