For investors anxious about the market’s stretched valuation, Wells Fargo said there is no bubble forming. The S & P 500 is currently trading about 25 times forward earnings after a 27% rally, which makes today’s valuation seem expensive at first glance since the 30-year average price-to-earnings ratio is at 19 times, Wells Fargo said. However, the Wall Street firm argued that it might be unfair to compare to the historical average because the index is more efficient than ever. Wells Fargo pointed out that profit margins of S & P 500 companies have nearly doubled over the past 15 years, while net debt to earnings have halved during the same time. “Stocks are not in a bubble, in our view, and investors should not let an above average P/E ratio keep them from participating in the continuation of the bull market we see in 2025,” Austin Pickle, Wells Fargo’s investment strategy analyst, said in a note. .SPX YTD mountain S & P 500 The Wall Street bank expects the S & P 500 will advance to 6,600 by the end of 2025, equivalent to about a 9% gain next year. The target is in line with the average forecast among top Wall Street strategists, which stands at 6,630 for 2025, according to CNBC Pro’s Market Strategist Survey. Wells Fargo believes deregulation under President-elect Donald Trump could help support earnings growth. The firm also said investors should look for pullbacks in the market to find entry points going forward. “Periods of volatility should be expected as 5-10% pullbacks are common. In such an instance, we expect to find a buying opportunity,” Wells said.

Stocks are not in a bubble, investors should keep buying: Wells Fargo

Related Posts

RECENT POSTS

Browse by Category

- Books (1)

- Business (3,576)

- Events (2)

- Fashion (5,602)

- Horror (1)

- Interviews (28)

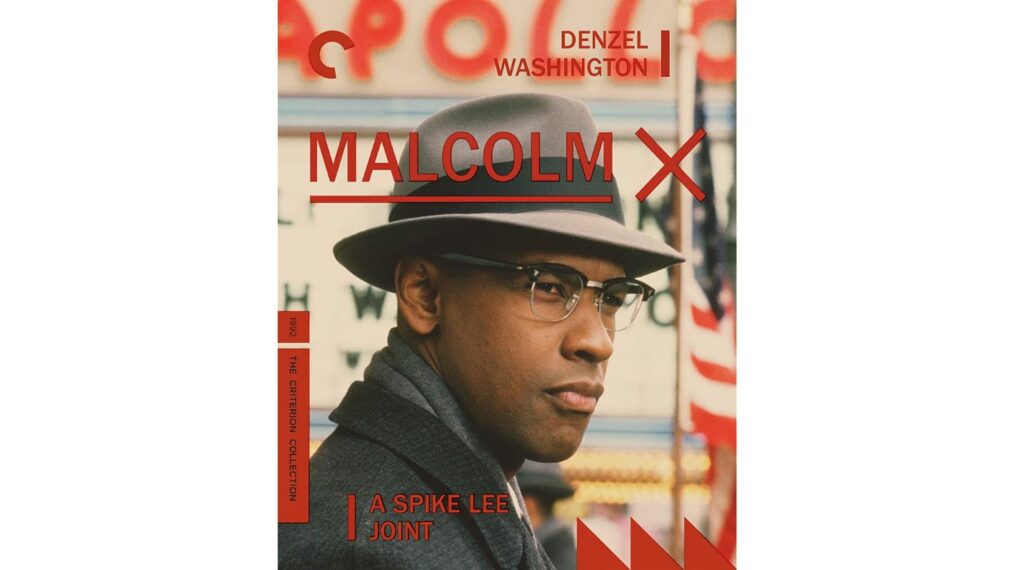

- Movies (5,598)

- Music (5,633)

- News & Gossip (6,295)

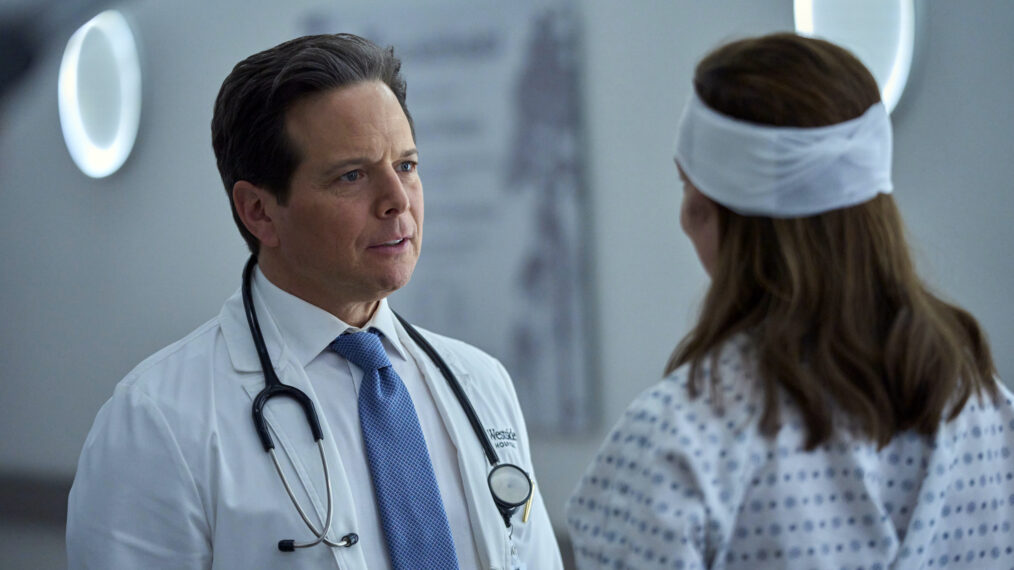

- Television (5,630)

- Uncategorized (1)

- Video Of The Day (909)

POPULAR POSTS

READERS' PICKS

EDITOR'S PICKS

© 2022 EssentiallyHollywood.com - All Rights Reserved

![‘The Traitors’ Recap, Season 3 Episode 4 — [Spoiler] Banished ‘The Traitors’ Recap, Season 3 Episode 4 — [Spoiler] Banished](https://tvline.com/wp-content/uploads/2025/01/the-traitors-recap-episode-4.png?w=650)

![Young Colton, Del and Evelyn in 1974 [VIDEO] Young Colton, Del and Evelyn in 1974 [VIDEO]](https://tvline.com/wp-content/uploads/2025/01/the-way-home-season-3.jpg?w=650)

:quality(85):upscale()/2025/01/15/863/n/49352476/9e69ba8767880fdc9084b2.84057222_.png)

:quality(85):upscale()/2025/01/15/049/n/1922564/a753b85967884eaf8fe5f9.34920179_.jpg)

![Iggy Azalea – Money Come [Official Music Video] Iggy Azalea – Money Come [Official Music Video]](https://i.ytimg.com/vi/7t5V5ygeqLY/maxresdefault.jpg)