Rachel Reeves has vowed to “invest, invest, invest” as she prepares to ramp up borrowing to fund a multibillion-pound capital programme at this month’s Budget.

But the UK chancellor also sought to assure jittery markets, telling the Financial Times she would install “guardrails” and was not in “a race to get money out of the door”.

“It’s about making prudent, sensible investments in the long term and we need guardrails around that,” she said.

In an interview, Reeves also indicated higher taxes would help fill a £22bn hole she has identified in the public finances and take pressure off government departments, some of which faced real-terms cuts. “There won’t be a return to austerity,” she said.

Reeves has signalled she wants to ease borrowing rules in her October 30 Budget, the first by a Labour government since 2010, to fund extra capital investment in areas such as green energy projects and transport schemes.

But Reeves said the Office for Budget Responsibility, the fiscal watchdog, and the National Audit Office, the spending watchdog, would have key roles in scrutinising her plans and assessing their long-term value.

“We will make sure that investment genuinely boosts growth and we will look at the role of institutions to demonstrate that, including, for instance, the NAO as well as the OBR,” she said.

Yields on the 10-year gilt were at 4.12 per cent on Friday, the highest since late July, partly reflecting concerns among investors that Reeves will sharply increase borrowing in the Budget.

Analysts have also argued that the chancellor should introduce robust reviews of investment to police valuations and net returns, reducing the risk that public money gets frittered away on poorly judged projects.

Reeves’s advisers have been discussing ways of ensuring the OBR fully reflects the growth-enhancing benefits of public investment as it pulls together its fiscal forecasts. “Invest, invest, invest is the theme of this Budget,” she said.

Part of the problem, however, is that the time needed to put projects in place mean the bulk of the growth benefits from new infrastructure projects can take longer than five years to be felt — even though this is the time horizon under which the chancellor is assessed under her fiscal rules.

“I hope that at the Budget the OBR will look at not just the short-term impact of boosting capital investment but also the long-term impact and the catalytic impact of public sector investment crowding in private investment,” she said.

Reeves was speaking on a train en route from London to Merseyside, where she and Prime Minister Sir Keir Starmer announced more than £21bn of support over 25 years to develop the carbon capture and storage industry.

The chancellor confirmed she was looking to revise her fiscal debt rule to “take account of the benefits of investment, not just the costs” but declined to say how much more borrowing this would allow for capital expenditure.

Reeves intends to stick to her rule that states that net debt as a share of GDP should be falling between the fourth and fifth year of the forecast, but crucially she is looking at changes to the way that debt is defined.

Switching to balance sheet measures such as public sector net worth or public sector net financial liabilities would boost budget headroom by upwards of £50bn by the end of the parliament, allowing her to borrow tens of billions more for investment.

Investors are seeking reassurances that only part of this extra borrowing capacity would actually be used if she went down this route.

Reeves inherited plans from the previous Conservative government that would have seen a succession of cuts in public sector net investment.

Reversing those cuts and keeping net investment at this year’s level as a share of GDP would imply £24bn of extra annual spending by 2028-29, the Institute for Fiscal Studies said. Treasury officials admitted it would be “difficult” to achieve that figure.

Reeves will also use her Budget to raise taxes to help boost day-to-day Whitehall budgets, ripping up spending plans by ex-Conservative chancellor Jeremy Hunt that implied real-terms cuts for “unprotected” departments such as justice and local government.

“The idea of this Budget is to wipe the slate clean and make an honest assessment of spending pressures and tax as well,” she said. “The previous government was relying on a fiction. The Budget is an opportunity to bring honesty to the public finances.”

Reeves hinted that the £22bn fiscal “black hole” she claims to have unearthed this year was not a one-off. Many of this year’s costs — such as higher public sector pay — will recur in later years, along with other unexpected costs, and would need permanent funding.

“The truth is, if you add £22bn every year, you’re underwater on the previous government’s fiscal rules,” she said. She has refused so far to set a timetable for balancing the current budget but said that “five years is obviously the maximum”.

Reeves said the need to find tax revenues to cover current costs was “the real binding constraint at this Budget”.

She suggested that the wealthy should accept that they would have to pay their share, arguing that “bringing back stability” to the public finances would create the foundations for growth and future wealth creation.

Higher taxes on private equity bosses, private school fees and non-doms — albeit scaled back — are expected in the Budget, with speculation of higher rates of capital gains tax. “I’m not being ideological about this but we need to raise money,” Reeves said.

Meanwhile, Reeves admitted that the public was unsettled by the recent controversy over free clothes and other gifts donated to senior Labour figures. The issue has come at a time of tough financial pressure and after her early decision to cut £1.5bn of winter fuel payments to about 10mn pensioners.

In 2023 and this year Reeves accepted a total of £7,500 from an old friend, which was used to buy clothes before the election. She also accepted tickets for an Adele concert.

“I do understand why people think it is a little bit odd,” she said. “I’ve not taken any of these donations since I became chancellor. It’s important when you’re in government that you’re held to higher standards because you’re actually making decisions that affect the public.”

![YOUNG LAMA X VTEN – DOLLA BILLS II [ OFFICIAL MUSIC VIDEO FOR DOLLA BILLS PART 2 ] YOUNG LAMA X VTEN – DOLLA BILLS II [ OFFICIAL MUSIC VIDEO FOR DOLLA BILLS PART 2 ]](https://i.ytimg.com/vi/bWkxG08iEo4/maxresdefault.jpg)

![Central Cee – No Introduction [Music Video] Central Cee – No Introduction [Music Video]](https://i.ytimg.com/vi/W4Gw9CIJDOU/maxresdefault.jpg)

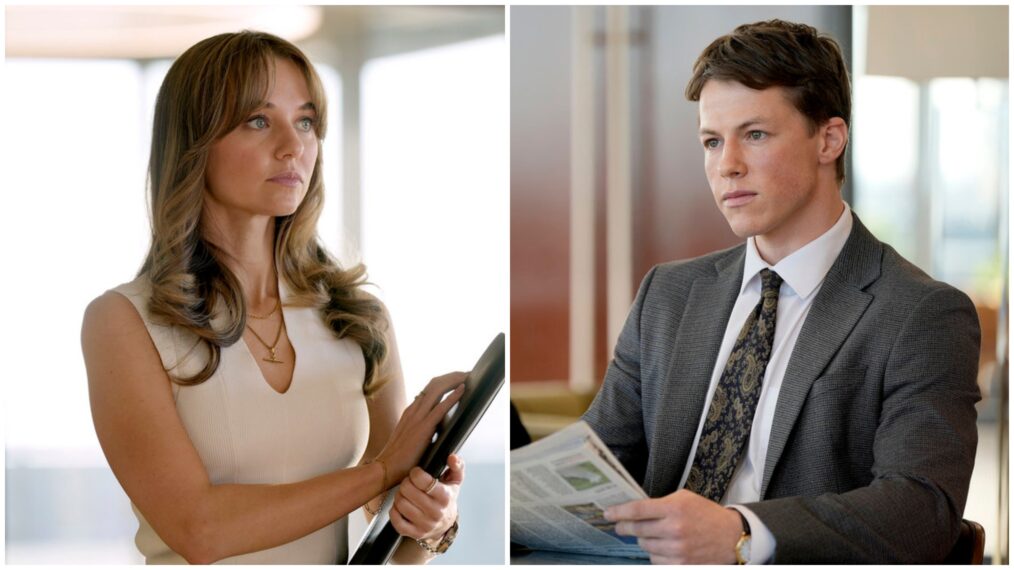

![‘Power Book II: Ghost’ Season 4 Finale Recap: [Spoiler] Dies ‘Power Book II: Ghost’ Season 4 Finale Recap: [Spoiler] Dies](https://tvline.com/wp-content/uploads/2024/10/power-book-ii-ghost-finale-recap-season-4-episode-10.jpg?w=650)