WeWork warns of ‘substantial doubt’ in continuing operations

WeWork, the US office space company SoftBank once valued at $47bn, has warned that it faces “substantial doubt” about its ability to continue as a going concern.

In an earnings report that showed $397mn in net losses for the second quarter, WeWork said its outlook depended on a series of plans including further restructuring and a search for additional capital over the next 12 months.

David Tolley, interim chief executive officer since Sandeep Mathrani stepped down as CEO in May, pointed to challenging property market conditions for a weaker than expected performance in recent months.

“Excess supply in commercial real estate, increasing competition in flexible space and macroeconomic volatility drove higher member churn and softer demand than we anticipated, resulting in a slight decline in memberships,” he said.

Penn swaps Barstool for ESPN in sports betting partnership

US sports betting company Penn Entertainment is ending its $551mn purchase of Barstool Sports and will instead co-brand its sportsbooks with Disney’s ESPN, a first for the cable network.

Terms of the deal between ESPN and Penn were not immediately disclosed, but Penn will rebrand its existing sports betting portals currently known as Barstool Sportsbooks to ESPN Bet, the companies said Tuesday.

The move comes barely six months after Penn completed its acquisition of Barstool, the sports gambling and entertainment site founded by Dave Portnoy. Penn bought 36 per cent of Barstool in 2020.

Jimmy Pitaro, chairman of ESPN, said that the alliance with Penn was borne out of increased demand for sports betting products among viewers.

Shares of Penn surged nearly 22 per cent to $30 in after hours trading on Tuesday, while shares of Disney rose slightly to $88.

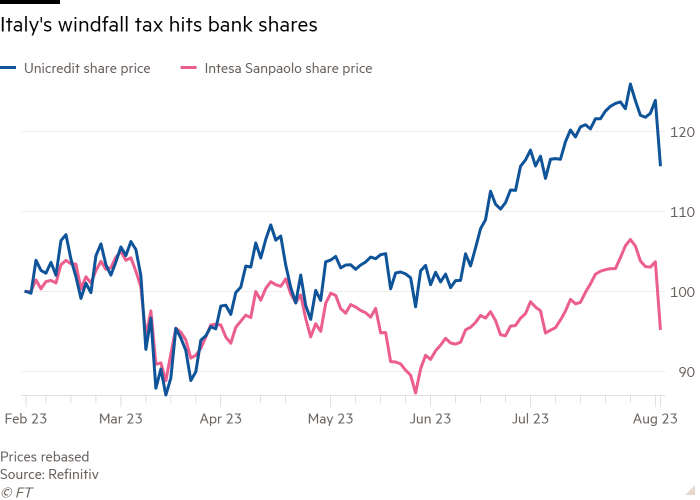

Italy backtracks with cap on windfall tax after bank shares tumble

Italy said late on Tuesday it would limit the impact of its planned windfall tax on banks to ensure financial stability, in an apparent partial backtrack after the surprise levy plan caused bank shares to drop sharply.

The finance ministry said in a statement that the tax on net interest income would be capped at 0.1 per cent of risk-weighted assets, a fifth of the level Citi analysts had earlier estimated the levy could reach.

A person with knowledge of discussions within government said the finance ministry had “scrambled” to come up with a solution that would at least “partially calm market jitters”.

The finance ministry said the cap was “aimed at safeguarding lenders’ financial stability”.

Read more on Italy’s windfall tax here

Electric truck maker Rivian raises full-year production target

Rivian said it will make 2,000 more trucks, vans and sport utility vehicles than originally planned for 2023, as it ramped up production in the second quarter.

The electric vehicle manufacturer now plans to build 52,000 vehicles this year at its plant in Illinois. Last month the company reported it built nearly 14,000 trucks, vans and SUVs in the second quarter, well above Wall Street expectations.

The company said in May that the supply chain would limit its ability to build vehicles, but on Tuesday said its outlook for its suppliers had improved, allowing it to raise volume guidance.

Eli Lilly lifts forecasts as weight-loss drug sales surge

Eli Lilly shares hit a record high after the pharmaceuticals group upgraded its 2023 revenue and profit forecasts following a surge in sales of its new diabetes and weight-loss drug Mounjaro.

The US drugmaker reported $979.8mn sales of Mounjaro in the second quarter amid red-hot demand for a medicine that a late-stage trial showed can slash a person’s body weight by a sixth. Lilly’s results beat analysts’ sales and profit expectations.

The drugmaker increased its full-year revenue guidance by $2.2bn to the range of $33.4bn to $33.9bn and upgraded its earnings forecasts.

Shares were up more than 15 per cent in afternoon trading.

US regulators approved Mounjaro last year to treat diabetes and analysts expect them to green-light its use as a weight-loss drug in the autumn, a move that would unlock an annual $50bn-plus market.

Google and Universal Music negotiate deal over AI ‘deepfakes’

Google and Universal Music are in talks to license artists’ melodies and voices for songs generated by artificial intelligence as the music business tries to monetise one of its biggest threats.

The discussions, confirmed by four people familiar with the matter, aim to strike a partnership for an industry that is grappling with the implications of new AI technology.

The rise of generative AI has bred a surge in “deepfake” songs that can convincingly mimic the voices, lyrics or sound of established artists, often without their consent.

Read more on Google and Universal here

Ukraine arrests woman accused of plotting Zelenskyy’s assassination

Ukraine’s intelligence service said it has detained a woman who was allegedly gathering information on President Volodymyr Zelenskyy’s travel details to help Russian forces carry out an assassination attempt.

In a separate case on Tuesday, the intelligence service (SBU) said it had arrested a group of women in Ukraine’s eastern Donetsk region for allegedly working for both Russia’s Federal Security Service (FSB) and the Wagner paramilitary group.

The SBU regularly detains citizens suspected of working on behalf of Russia but the alleged assassination plot stands out for its high-profile target. If found guilty, the woman could face up to 12 years in prison.

Read more about the assassination plot here

Risers and fallers in the US

Share moves to note on the New York Stock Exchange include Eli Lilly, Beyond Meat, and Tilray Brands:

-

Shares of pharmaceutical group Eli Lilly jumped 16.8 per cent, hitting a record high. The group beat expectations and raised its guidance on strong demand for its new weight loss drug Mounjaro.

-

Beyond Meat shares plunged 19 per cent after the company cut its annual forecast on Monday, when it reported weak demand for its plant based meat and cut its sales outlook.

-

Cannabis company Tilray Brands saw shares soar 29.3 per cent after the company announced a deal to purchase eight beer and beverage brands from Anheuser Busch.

Weak bank stocks weigh on US markets

Bank stocks were among the biggest decliners in the US on Tuesday after credit rating agency Moody’s cut the ratings of 10 midsized US banks overnight, citing possible declines in deposits and weaker profitability.

The news reignited investors’ concerns over the health of the US banking sector, which struggled earlier in the year after the collapse of three regional lenders. The KBW Bank index declined 2.8 per cent.

The agency also placed four larger lenders on review, leaving the door open for more downgrades to come. Shares of US Bancorp fell 2.4 per cent, and Truist Financial lost 3.1 per cent, as both made the Moody’s list.

Read more on markets moves here

Poland sets October date for elections as incumbents seek third term

Poland will hold parliamentary elections on October 15, when the country’s rightwing government will be seeking a third term in office.

President Andrzej Duda, who cancelled a planned visit this week to South Korea, made the announcement on Tuesday on social media just days before the deadline for fixing the election calendar.

Recent opinion polls suggest that neither the ruling Law and Justice party (PiS) nor the main opposition Civic Platform will have a majority in October, which could force complicated coalition talks after a fiercely contested vote.

PiS founder Jarosław Kaczyński told party supporters last weekend that the election will be “the most important” since the vote in 1989 that paved the way for Poland’s return to democracy after the fall of the Berlin Wall.

‘Hostile actors’ hacked UK’s electoral register to access voter data, watchdog reveals

The UK’s elections watchdog has suffered a “complex cyber attack” in which hackers accessed its servers and obtained copies of the electoral register.

The Electoral Commission revealed on Tuesday that “hostile actors” first breached its systems in August 2021, but the attack was not identified until last October.

The data accessed included the names, addresses and date upon which a person reached voting age, of all those who registered for a ballot between 2014 and 2022, as well as details of overseas voters. The data of voters who registered anonymously was not accessed.

“We understand the concern this attack may cause and apologise to those affected,” the commission said.

Top Goldman Sachs executive John Rogers steps down as chief of staff

John Rogers, one of Goldman Sachs’ most influential executives with closes ties to its board of directors, is stepping down as the bank’s chief of staff.

Rogers, 67, is handing over the role to Russell Horowitz, a former Goldman partner who left the bank in 2020 and most recently worked at Citadel, the bank announced in a memo to staff on Tuesday.

Rogers is remaining at Goldman as executive vice-president and secretary to the board.

SEC hits Wall Street businesses with almost $300mn in fines

Eleven Wall Street businesses have agreed to pay a total of $289mn in fines over messaging violations in the latest round of record-keeping charges filed by the US Securities and Exchange Commission.

The US regulator accused broker dealers including Wells Fargo Securities and BNP Paribas Securities of “widespread and longstanding failures . . . to maintain and preserve electronic communications”, the SEC said on Tuesday.

Wells Fargo said it was “pleased to resolve this matter”. BNP Paribas declined to comment.

“Compliance with the books and records requirements of the federal securities laws is essential to investor protection and well-functioning markets,” Gurbir Grewal, director of the SEC’s enforcement division, said in a statement.

Eleven separate Wall Street banks and brokers in September agreed to pay more than $1.8bn in fines over similar charges.

UK targets Russia’s access to foreign military supplies with fresh sanctions

The UK government has unveiled 25 new sanctions targeting Russia’s access to foreign military supplies, under a package the Foreign Office claims is its “largest” such raft of measures to date.

Britain on Tuesday designated three Russian companies importing electronics crucial to Moscow’s battlefield kit, as well as 22 individuals and businesses outside Russia that are supporting its full-scale invasion of Ukraine.

Two Turkish companies exporting microelectronics to Russia and a Dubai-based business providing drones to Moscow have been blacklisted, along with Slovakian national Ashot Mkrtychev over his alleged involvement in an attempted arms deal between North Korea and Russia.

The UK has also imposed fresh sanctions on Iranian individuals and entities developing drones, as well as Belarusian defence companies, in a bid to hit Russia’s war machine.

Cinema chain AMC off to ‘explosive’ start to the quarter thanks to Barbie and Oppenheimer

AMC Entertainment said the current quarter is off to an “explosive” start thanks to hit movies Barbie and Oppenheimer.

The cinema chain also reported a surprise quarterly profit — its first since 2019 — reporting net income of $8.6mn in the three months that ended in June.

Revenue jumped 15.6 per cent from a year ago to $1.3bn, as attendance grew 12 per cent and per-patron revenue exceeded pre-pandemic norms due to an uptick in demand for food and beverages. Both revenue and profit beat analyst expectations.

Chief executive Adam Aron said the 2023 US industry box office is 20 per cent ahead of last year. He added films like Barbie and Oppenheimer had brought in the highest monthly revenue in AMC’s 103-year history.

TSMC to diversify production with €10bn German joint venture

Taiwan Semiconductor Manufacturing Company plans to go ahead with a heavily subsidised €10bn plant in Dresden with automotive supplier Bosch and chipmakers Infineon and NXP, the four companies said on Tuesday.

It marks another big step by the world’s largest contract chipmaker towards globalising its manufacturing in response to customer concerns over geopolitical tension around its home base Taiwan.

TSMC’s board of directors approved an equity investment of up to €3.5bn in European Semiconductor Manufacturing Company (ESMC) GmbH. The joint-venture, of which the Taiwanese company will own 70 per cent and its three European partners will hold 10 per cent each, aims to start construction in the second half of next year and start production by the end of 2027.

UPS cuts forecast after Teamsters deal

Delivery group UPS has detailed the cost of its labour agreement with the Teamsters union, saying that the deal will hit revenues and margins this year.

The company reached a pay deal last month with Teamsters, which represents 300,000 of its employees, after lengthy negotiations.

On Tuesday, the company pushed down its financial guidance for the year “to reflect the volume impact from labour negotiations and the costs associated with the tentative agreement”.

UPS now expects revenue to be around $93bn this year, down from previous guidance of $97bn, while the adjusted operating margin will be 11.8 per cent, down from earlier guidance of 12.8 per cent.

Novo Nordisk’s Wegovy cuts risk of heart attack or stroke by 20%

Novo Nordisk’s obesity drug cuts the risk of major cardiovascular events such as heart attacks or strokes by 20 per cent compared with a placebo, bolstering the Danish drugmaker’s case that health systems should pay for the medicines.

Shares in Novo Nordisk surged 16 per cent in mid morning trading after it published the headline results of a trial for its drug Wegovy that enrolled 17,604 adults aged 45 or older.

Martin Holst Lange, executive vice president for development at Novo Nordisk, said until now, there has been no approved weight management drug that helps patients lose weight and reduces the risk of heart attack, stroke or cardiovascular death.

Cornish Lithium secures $67mn boost to mine development

Cornish Lithium has secured $67mn of investment led by the UK Infrastructure Bank in a huge boost for the company’s efforts to develop mines producing the metal used in electric car batteries in south-west England.

The funding marks the first direct equity investment by the UK Infrastructure Bank, set up in 2021 to draw private financing into climate change-related infrastructure projects, boosting Cornwall’s prospects of becoming a European hub for lithium supply.

“The funding package is expected to significantly accelerate progress toward the creation of a domestic supply of battery grade lithium,” Cornish Lithium said in a statement, adding that the $67mn was part of a potential larger funding package of up to an additional $210mn.

European and Asian stocks fall on weak Chinese export data

Stocks retreated in Asia and Europe on Tuesday after new data showed China’s exports fell by the most since the beginning of the Covid-19 pandemic, amplifying concerns over the country’s economic growth.

Europe’s region-wide Stoxx Europe 600 index fell 0.2 per cent in the first hour of trading, after the Italian government stunned investors with plans for a windfall tax on banks.

Italian lender Intesa Sanpaolo was among the biggest fallers, giving up 6.9 per cent after the country’s deputy prime minister announced a 40 per cent windfall tax on banks.

Hong Kong’s Hang Seng index dropped 1.7 per cent, led by declines in consumer goods and property, while China’s benchmark CSI 300 was down 0.3 per cent.

Read more from the Markets Briefing here

July hottest month ever recorded, climate scientists confirm

July was officially the hottest month ever recorded, at around 1.5C warmer than the average for the period 1850 — 1900, scientists at the EU’s Copernicus Climate Change Service confirmed on Tuesday.

They said 2023 was the third-warmest year ever, and that global average sea surface temperatures reached record highs in July.

The record heat was fuelled by man-made climate change, which contributed to the Antarctic sea ice extent reaching its lowest ever level for July.

Risers and fallers in Europe

Big share price moves in Europe today include BPER Banca and other Italian banks, UK asset manager Abrdn, and French pharma company Ipsen:

-

BPER: Shares in the Italian lender slid 10 per cent, making it the biggest loser on the Europe-wide Stoxx 600 index, after Rome announced a windfall tax on bank profits to counter the effects of rising interest rates.

-

Abrdn: Shares fell 8 per cent after the asset manager reported record outflows for the first half of the year as investors pulled money out of its funds.

-

Ipsen: Shares gained 2 per cent after the French pharma company upgraded its full-year guidance after sales grew more than 6 per cent.

Italian bank shares fall as government approves windfall tax

Shares in Italian banks dropped sharply on Tuesday morning after the government on Monday evening approved a windfall tax on bank profits.

Shares in Intesa Sanpaolo and UniCredit, the country’s two largest banks, fell by 8 per cent and 7 per cent, respectively, in early trading.

In a tweet on Monday, deputy prime minister Matteo Salvini said the tax was “common sense”, and that the proceeds of the tax would be used to help families and businesses affected by the rise in interest rates.

UK’s biggest pawnbroker reports sharp rise in profits during cost of living crisis

H&T Group, the UK’s largest pawnbroker and a retailer of new and used jewellery, said profits rose 31 per cent in the first half, following sharp increases in both pawnbroking revenues and the size of the pledge book — the value of loans secured against pawned items.

Profits increased to £8.8mn, while the pledge book rose 35 per cent £114.6mn. H&T said that the rise in activity reflects its customers’ difficulties in meet living expenses.

“We anticipate continued strong demand for our core pawnbroking product as the impact of inflation on the consumer increases the need for small-sum, short-term loans,” it said.

Abrdn first-half outflows swell to £4.4bn

Outflows at FTSE 100 investment group Abrdn grew 16 per cent in the first half of the year to £4.4bn as the “challenging macro environment” dented investor sentiment.

The outflows took the group’s assets under management and administration down 1 per cent to £496bn, falling below analysts’ expectations.

However, Abrdn’s pre-tax losses slowed to £169mn in the first six months of the year, from a loss of £326mn last year.

The outlook for global markets “remains uncertain” and it is “taking actions to put our investments business on a better footing”, the company said on Tuesday.

Chief executive Stephen Bird said: “We continued to move at pace to execute our strategy over the first six months of 2023 in a challenging macro environment.”

Profits halve at Glencore as coal prices fall

Profits halved at Glencore, the Switzerland-based mining group, in the first six months of the year as high energy prices and commodity market volatility triggered by Russia’s invasion of Ukraine subsided.

The FTSE 100 company’s earnings before interest, tax, depreciation and amortisation fell by half to $9.4bn in the period, mainly because of declining coal prices.

Glencore announced additional shareholder returns of $2.2bn — a level far below the previous year — taking the total for the year to $9.3bn.

The company has put aside $2bn of cash in case it is successful in acquiring Teck Resources’ steelmaking coal business.

Softbank’s third straight quarter of losses dashes hopes for recovery

SoftBank Group spent a third straight quarter in the red, recording a ¥477.6bn ($3.3bn) loss for the April to June period despite market hopes for a solid return to profit.

Although the loss was heavy, it was significantly better than the same quarter a year earlier, when SoftBank made a loss of ¥3.16tn.

SoftBank’s losses were partially offset by a long-awaited improvement in performance at the company’s Vision Fund investment arm, which booked an investment gain of ¥159.77bn.

Before the April to June period, the flagship unit had logged five consecutive quarters of losses, suffering from a plunge in global tech valuations. In the January to March quarter, the Vision Fund unit’s losses were ¥237bn.

Country Garden misses bond coupon payments as liquidity pressures escalate

Chinese property developer Country Garden has missed coupon payments on two international bonds due on Sunday, in a sign of mounting liquidity pressures.

The bonds, due in February 2026 and August 2030, are trading at 13.097 and 11.398 cents on the dollar, respectively.

The developer, the biggest in China by sales, is one of the few private businesses to survive a sector-wide cash-crunch so far. Last week it cancelled a $300mn share placement at the last minute.

Country Garden on Tuesday said its funds had declined and it was experiencing “liquidity pressure” and was seeking to “actively optimise” its debt arrangements.

Sales across China’s biggest developers have slumped this year amid a broader economic slowdown.

Death toll rises after Russian strike on eastern Ukrainian town

The death toll from a Russian strike on the eastern Ukrainian town of Pokrovsk has risen to seven, with more than 60 injured, Ukrainian officials said on Tuesday.

The town was struck on Monday evening by two Iskander short range ballistic missiles. A block of residential flats and a hotel popular with journalists and military personnel suffered direct hits.

Pokrovsk has been hit intermittently since the full-scale invasion began in February 2022 but never on this scale. The hotel and the town itself was considered a safe distance from the front line.

The number of injured was at least 67 as of 7am Kyiv time on Tuesday, Pavlo Kyrylenko, head of the Donetsk regional administration, wrote on Telegram.

Law firm Dentons hives off China business as Beijing tightens regulation

Dentons, the largest western law firm in China by headcount, is hiving off its operation in the country in response to Beijing’s intensifying regulation of foreign companies.

The firm informed clients on Monday it was making the move due to the “evolving regulatory environment for Chinese law firms”, including new requirements “relating to data privacy, cyber security, capital control and governance”.

The decision by Dentons comes amid worsening prospects for foreign companies in the country as the Chinese government expands cyber security and data protection laws on national security grounds.

Read more about Denton’s China operations here.

What to watch in Europe today

Events: Scottish students receive results for their National 5, Higher and Advanced Higher exams, broadly equivalent to the GCSEs and A-levels taken across the rest of the UK. Mozambique President Filip Nyusi concludes an official visit to the Czech Republic.

Indicators: Germany issues final July consumer price index and harmonised index of consumer prices inflation rate data. France presents trade figures for June. In the UK, the BRC-KPMG retail sales monitor comes out.

Results: Abrdn, Glencore, InterContinental Hotels Group and IWG report half-year earnings, while Bayer provides figures for the latest quarter.

Chinese exports tumble as post-pandemic economic woes deepen

China’s exports fell by the most since the beginning of the Covid-19 pandemic, official data showed on Tuesday, deepening concerns over the country’s economic growth.

Exports fell by 14.5 per cent year-on-year, the most since February 2020. Imports fell by 12.4 per cent. Economists polled by Reuters had forecast declines of 12.5 and 5 per cent respectively.

A weaker climate for global trade is one of the main sources of pressure on policymakers in Beijing, who are also grappling with a weak property sector and a limp recovery since anti-pandemic measures were lifted at the end of last year.

China stocks fall and renminbi weakens ahead of trade data release

Chinese stocks fell and the renminbi weakened ahead of the release of the country’s official trade figures on Tuesday, as concerns over consistently weak exports this year weighed on sentiment.

Hong Kong’s Hang Seng index fell 1.7 per cent, led by falls in the healthcare and real estate sectors, while China’s CSI 300 dropped 0.5 per cent. The renminbi weakened by as much as 0.4 per cent to a low of Rmb7.2193 per dollar, its weakest level since mid-July.

Investors are looking to China’s July trade figures. Exports had provided the economy with a lifeline during the pandemic but have repeatedly underperformed this year.

Hybe boosted by girl band NewJeans and solo acts while BTS is on hiatus

Hybe, the South Korean music label behind global K-pop sensation BTS, reported an 18.7 per cent jump in second-quarter net profit on surging album sales and a post-pandemic revival in demand for concerts.

Net profit rose to Won117.4bn ($89.4mn) in the April-June period from Won98.9bn a year earlier. Sales increased 21 per cent to Won621bn.

While BTS is on hiatus as some of its members complete mandatory military service, other members are continuing their solo activities.

Hybe’s new girl group NewJeans is also gaining global popularity, helping the company reduce its dependence on BTS.

Elon Musk’s X Corp accuses anti-hate group of illegally receiving data

Elon Musk’s X Corp has accused the Center for Countering Digital Hate of illegally receiving data from the European Climate Foundation in its lawsuit against the nonprofit.

In an amended complaint, the social media platform accused the US group of “conspiring” with the climate group, which it claims “improperly shared login credentials” with the non-profit.

Data was then used to suggest “X is overwhelmed by harmful content, and then used that contrived narrative to call for companies to stop advertising on X”, the lawsuit said.

European Climate Foundation did not immediately respond to a request for comment.

X is battling against claims of unhealthy content on its platform as it tries to win back advertisers concerned by such allegations.

Korea’s LG Energy Solution to build battery recycling plants in China

LG Energy Solution on Monday signed a preliminary agreement to build its first battery recycling joint venture with China’s Zhejiang Huayou Recycling Technology to ensure supply of key raw materials.

The joint venture will build two battery recycling plants in China – a pretreatment plant in Nanjing, where LGES already has battery production, and a post-processing plant in Quzhou to utilise Huayou Cobalt’s existing infrastructure.

The new plants will start operations in late 2024 to produce recycled metals, using battery scrap generated from LGES’s Nanjing plant and waste batteries collected by Huayou. The recycled metals, including nickel, cobalt and lithium, will be processed and supplied back to the Nanjing plant.

What to watch in Asia today

Events: The Lok Sabha, India’s lower house of parliament, begins debate on a no-confidence motion moved by the opposition. Prime Minister Narendra Modi is expected to reply on Thursday. The Reserve Bank of India’s monetary policy committee begins a three-day meeting. The 31st World University Games, or Universiade, concludes in Chengdu. About 10,000 students from 150 countries competed in the event, originally set for summer of 2021 but postponed by the Covid-19 pandemic.

Indicators: China releases July trade data, while Japan announces June household spending and July bank lending figures. The Bank of Korea issues June balance of payments figures. Malaysia releases an industrial production index and Taiwan provides July consumer price index data. New Zealand issues residential property values for July.

Earnings: Japanese conglomerate SoftBank Group releases quarterly earnings, as does Chinese electric-car maker Li Auto, Australian-founded building materials manufacturer James Hardie Industries and South Korea’s SK Telecom and entertainment group Hybe.

Online homework helper Chegg shrugs off AI threat concerns

Wall Street’s worries that generative artificial intelligence systems such as ChatGPT pose a threat to the online education sector appeared to ease on Monday, after US provider Chegg reported stronger-than expected results for its latest quarter.

Earlier this year Chegg was seen as the first public company to be hit by the AI-powered chatbot after it said some subscribers were turning to the free OpenAI service for answers, affecting its revenue.

Chegg’s shares rebounded in after-hours trading on Monday by 25 per cent following stronger than expected quarterly results. It said a “conversational” service launched in May, also powered by generative AI, appeared to be catching on with students.

Beyond Meat cuts positive cash flow goal and slashes full-year sales outlook

Beyond Meat abandoned its hopes of becoming cash flow positive this year and cut its sales outlook, sending its shares down more than 8 per cent in extended trading.

The artificial meat maker cited weak demand for its products multiple times in its latest earnings report, where it missed Wall Street’s expectations for revenues, but recorded a narrower loss than forecast.

The company downgraded its full-year revenue outlook to a range of $360mn and $380mn, down from $375mn to $415mn.

Beyond Meat said it no longer expected to be cash flow positive in the second half of 2023, “in light of greater than expected consumer and category headwinds and their anticipated impact on net revenues”.

Ukraine says Russian strike on Pokrovsk city centre kills 5 people

Russian forces launched a rocket attack on the town centre of Pokrovsk in Ukraine’s eastern Donetsk region, killing five people and wounding at least 31, Ukrainian officials said.

The Druzhba hotel, frequented almost entirely by journalists and military personnel, suffered a direct hit. It is not clear how many guests were staying at the hotel.

Ukraine’s interior ministry said that among the injured were 19 police officers and five rescue workers who were caught in a second barrage when they arrived at the scene. The deputy head of the service for the Donetsk region was among those killed, they said.

Journalists chose to stay at the hotel because it was deemed to be a relatively safe distance from the frontline.

KKR agrees $1.6bn deal for book publisher Simon & Schuster

Private equity firm KKR has agreed to buy US book publisher Simon & Schuster from Paramount Global for $1.62bn.

The agreement relieves Paramount of a top-five US book publisher as it seeks to focus on its video streaming business. Shares of the media group rose 4 per cent in after-market trading.

The new price tag is less than the $2.2bn that rival publisher Penguin Random House offered for Simon & Schuster in 2020. A US judge blocked the proposed deal on antitrust grounds, saying the merger would harm competition for publishing rights on major titles and cut into author pay.

![Mason Ramsey – Twang [Official Music Video] Mason Ramsey – Twang [Official Music Video]](https://i.ytimg.com/vi/xwe8F_AhLY0/maxresdefault.jpg)

![Fear the Walking Dead Recap: [Spoiler] Bitten in Season 8, Episode 4 Fear the Walking Dead Recap: [Spoiler] Bitten in Season 8, Episode 4](https://tvline.com/wp-content/uploads/2023/05/FTWD_804_LS_0902_0768-RT.jpg?w=300)

:quality(85):upscale()/2025/01/15/049/n/1922564/a753b85967884eaf8fe5f9.34920179_.jpg)