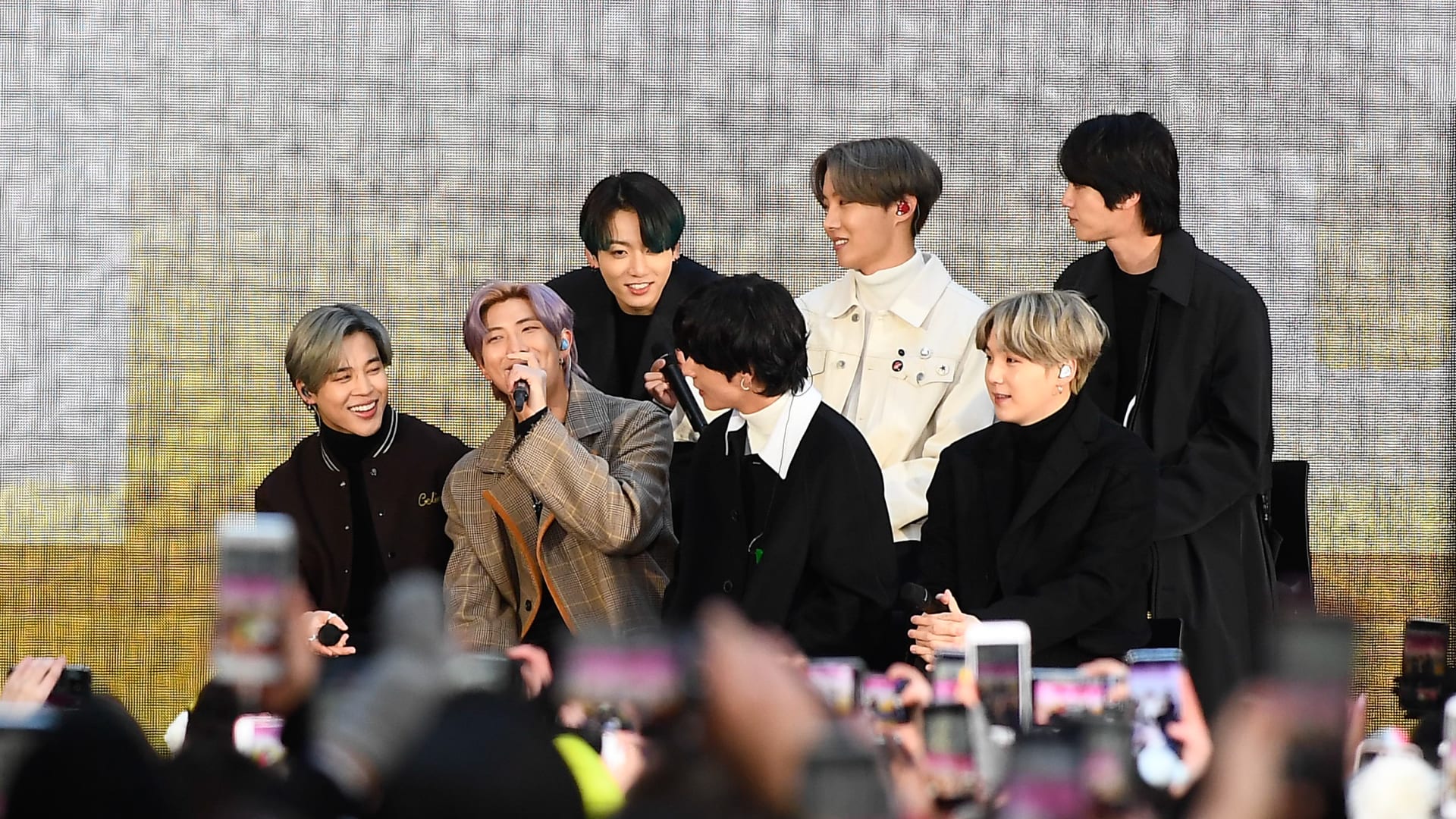

K-pop is a music phenomenon that stretches far beyond South Korea — and for investors wanting to cash in, there are just a few major agencies behind its more than 300 groups. Bokyung Suh, director and senior research analyst at Bernstein, is bullish on one of them in particular. His pick is K-pop agency Hybe, which he’s given an outperform rating and a target price of 350,000 South Korean won ($258) — or around 44% upside from Tuesday’s close. Hybe’s roster of artists includes BTS — one of the biggest South Korean boy bands. Hybe, which is listed on the Kospi , is one of K-pop’s most prominnt players, along with Kosdaq-listed SM Entertainment, JYP Entertainment and YG Entertainment. “I believe in the sector for the long-term growth and the macro trend,” Suh told CNBC’s ” Street Signs ” on Monday. Although Bernstein only covers Hybe, Suh said, “as long as the global players such as Disney, Netflix and Spotify will spend more and more money for K-contents, the biggest beneficiaries will be the adjacent K-pop players and on the value chain as well.” He estimates that there are about 500 million K-pop fans in the world, and he expects this figure to grow. Suh highlighted that Netflix announced in April that it would invest $2.5 billion in South Korean media over the next four years. He also pointed to Netflix CEO Ted Sarandos’ visit to South Korea in June , where Sarandos revealed that “K-content” viewership rose sixfold in the last four years alone, and that more than 90% of watchers of Korean romance shows on Netflix are from outside the country. Why the Hybe hype Suh has a specific reason for choosing Hybe: its intellectual property “diversification.” “We know that entertainment is often considered as a lottery business, as we cannot easily forecast the future and performance before launching the IP, such as Squid Game or Game of Thrones. So this is the reason why the global leading enterprise entertainment players companies try to diversify their IP portfolio to run their business more sustainably.” According to Suh, BTS makes up about 32.8% of Hybe’s revenue, followed by boy band Seventeen (30%), which is managed by Hybe subsidiary Pledis Entertainment. Rookie boy band Tomorrow X Together makes up 15% of revenue, while girl group NewJeans — which debuted in 2022 under subsidiary ADOR — accounts for about 5-10%. Most recently, Hybe renewed its contracts with BTS for an unspecified amount of time, a development that will ease concerns about Hybe’s “long term growth story,” Suh wrote in a Sept. 20 note. BTS’ contract was due to expire in 2024. “This, we believe, will generate highly positive sentiment because it proves the company’s strong talent management capability and the transparent and agile IR practice.” In contrast, shares recently tumbled on media reports that three of four members of girl group Blackpink would not renew their contracts with YG Entertainment. As BTS members have already begun or will begin South Korea’s two-year mandatory military service, Suh said, the band’s reunion — and its impact on Hybe’s balance sheet — will take place around early 2026.

Investing in K-pop? Bernstein is a fan of this stock

Related Posts

RECENT POSTS

Browse by Category

- Books (1)

- Business (3,475)

- Events (2)

- Fashion (5,451)

- Horror (1)

- Interviews (28)

- Movies (5,447)

- Music (5,481)

- News & Gossip (6,219)

- Television (5,477)

- Uncategorized (1)

- Video Of The Day (883)

POPULAR POSTS

EDITOR'S PICKS

© 2022 EssentiallyHollywood.com - All Rights Reserved

:quality(85):upscale()/2023/09/27/650/n/1922564/f444d70d65143de0608650.07854929_.jpg)