Stay informed with free updates

Simply sign up to the Travel & leisure industry myFT Digest — delivered directly to your inbox.

Ennismore, the group behind the Hoxton hotel chain, is betting on the Middle East and the Americas for its growth after warning that Europe is becoming “challenging” for hotel development.

The company, which is backed by hotel group Accor, operates more than 37,000 hotel rooms in more than 170 hotels around the world and plans to add a further 27,000 in the next few years. It has 17 hotel and restaurant brands including Mondrian.

The Middle East, which accounts for 43 per cent of its rooms now will take the lion’s share of this growth — 70 per cent — while room numbers in the Americas, which currently account for less than a fifth of the total, will grow 61 per cent.

In Europe, whose 13,000 rooms account for about a third of the present total, the number of new rooms will grow by about 35 per cent.

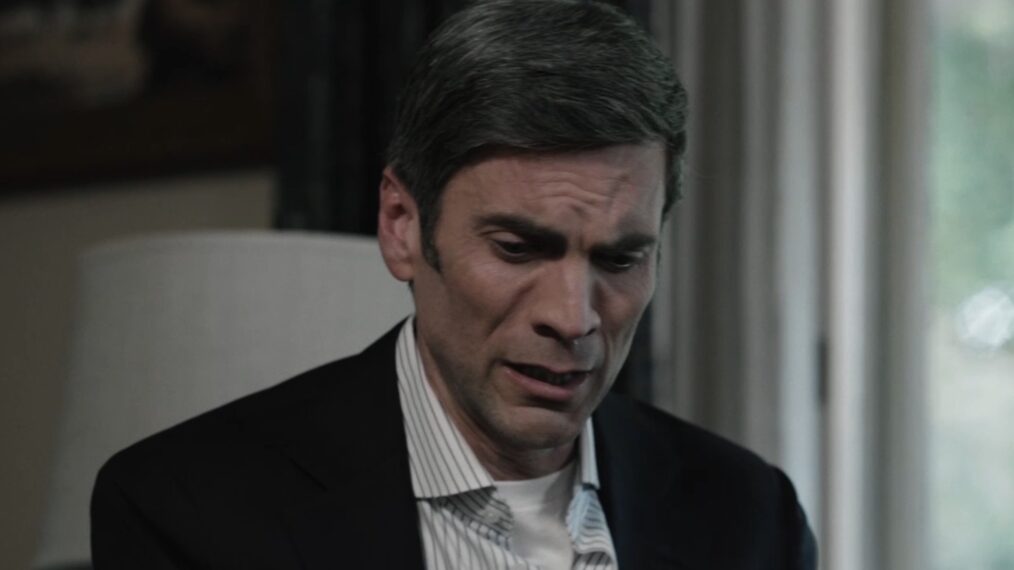

“Europe generally is a lot more challenging than perhaps some of the other areas,” Sharan Pasricha, founder and co-chief executive of Ennismore, told the Financial Times.

The group, which already had offices in New York and Dubai, set up earlier this year new teams in Cancún and Riyadh to expand further in the regions.

In Europe, Ennismore has “smaller properties . . . sometimes they take a bit longer to develop than other regions and other jurisdictions, versus properties that we have in the Middle East and in the Americas that are considerably bigger, develop a lot faster and have some strong feeder markets attached”, added Pasricha, the son-in-law of Indian billionaire businessman Sunil Bharti Mittal.

Ennismore, which also runs Scotland’s Gleneagles resort, does not own any of its hotels but instead partners with “sovereign wealth funds, family offices, high net worth individuals [and] real estate developers to manage their real estate” using its brands, Pasricha said.

The company said in June that it would take over management of Our Habitas, a wellness and experience-driven hotel company which runs 10 resorts in places such as Mexico’s Tulum and Saudi Arabia’s AlUla oasis.

Co-chief executive Gaurav Bhushan said that under Ennismore’s operation, Our Habitas “should be able to add 20 to 30 new properties over the coming years” predominantly in these regions.

Ennismore merged with some Accor brands to form a joint venture in 2021, with the latter taking a majority stake. Ennismore is now also backed by a Qatari consortium which acquired a near-11 per cent stake from Accor the following year in a deal that valued the company at more than €2bn.

Accor does not disclose Ennismore’s financial performance. When asked if Ennismore needed more funding for the expansion, Pasricha said: “Our business is asset light, so it’s incredibly cash generative. We don’t need the capital for running the business as it’s more than profitable.”

Global hotel chains are seeking ways to expand to tap into booming tourist demand but room growth has been muted.

The number of rooms in construction has declined nearly 8.5 per cent from its 2019 peak driven by higher costs, ongoing supply chain disruption and lack of land, said Zach Demuth, property group JLL’s global head of hotels research. He added that Europe had also been affected by labour shortages and long planning permission times.

Global hotel supply is expected to grow an average of just 2.4 per cent over the next five years, significantly down from its long-term average of 4.2 per cent, according to JLL.

The Middle East is one of a few areas where hotel development is accelerating, thanks to its availability of capital and labour. The Saudi Arabian government, which has increased its target to lure 150mn visitors by the end of the decade, is using the kingdom’s more than $900bn Public Investment Fund to develop new tourist attractions such as AlUla and the futuristic city of Neom.

“The amount of money that’s been spent on how they create tourism demand is staggering,” said Demuth.

In the Americas, Bhushan said the company would particularly focus on Mexico and the Caribbean to “capture the American customer” including in all-inclusive luxury hotels. It will open the SLS Playa Mujeres Cancún in November as its first all-inclusive resort in the region.

The region is witnessing tourism growth helped by US visitors. Juan Pedro Sáenz-Diez, head of hotels for Mexico and the Caribbean at CBRE, said the company expected “strong consumer interest in the region”, with US visitors to Mexico and the Caribbean surpassing pre-pandemic levels.

A new airport in Tulum and the newly opened Maya Train are “poised to support incremental growth for years to come”, he added.

![Two Neighbors – The Summer (Official Music Video) [7clouds Release] Two Neighbors – The Summer (Official Music Video) [7clouds Release]](https://i.ytimg.com/vi/IpUWOGlVPio/maxresdefault.jpg)