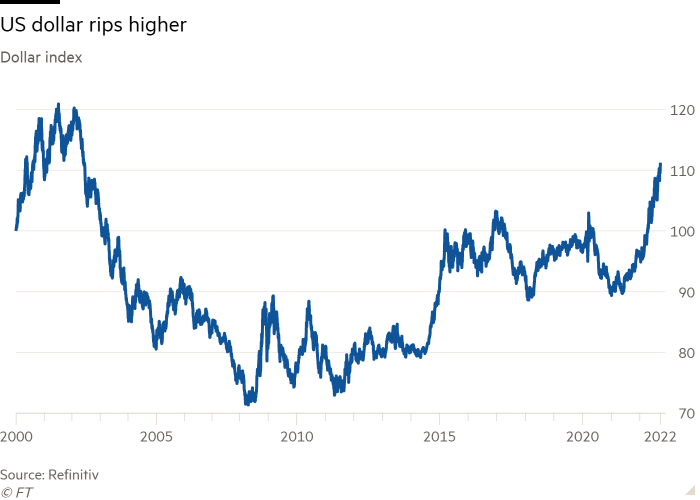

The dollar hit a new 20-year high on Wednesday after President Vladimir Putin said Russia’s armed forces would call up reserve troops, in a move that is expected to prolong the war in Ukraine.

An index measuring the greenback against six peers added as much as 0.6 per cent in early London dealings to reach the highest level since 2002. The pound dropped 0.4 per cent to $1.133 and the euro lost 0.7 per cent to consolidate below parity at $0.99. An MSCI index of emerging market currencies slipped 0.2 per cent.

The dollar is widely perceived as a haven currency during times of geopolitical tension and economic stress.

“The dollar has retained good momentum so far this week, largely benefiting from safe-haven demand as risk sentiment has remained quite fragile,” said Francesco Pesole, an FX strategist at ING, the Dutch bank.

Japan’s yen, which often advances as domestic investors bring funds home during periods of market tumult, added 0.3 per cent on Wednesday to ¥143.33 against the dollar.

Victoria Scholar, head of investment at the fund supermarket Interactive Investor, said that Putin’s address was “spurring safe-haven demand” for the yen.

“The yen hasn’t been carrying out its function as a typical safe-haven asset amid this year’s global economic uncertainty because of rising interest rate differentials between Japan and other economies which have favoured currencies such as the US dollar instead,” said Scholar.

She added that a combination of haven demand and the Fed’s expected rate hike were driving demand for the dollar against most major currencies.

“The dollar is rallying more aggressively against the euro than the pound given that the Bank of England on Thursday is expected to follow the Fed with a similarly hawkish rate increase. The interest rate differential allure of the dollar post the Fed is only likely to last one day against the pound if we see a similar [0.75 percentage point] hike from the Bank of England.”

Equity traders in Europe braced themselves for a bumpy session after losses in the US on Tuesday that were followed by a broad retreat across Asian shares.

The FTSE 100 added 0.6 per cent by mid-morning in London while the regional Stoxx Europe 600 gauge added 0.3 per cent after opening lower.

Hong Kong’s Hang Seng index slid 1.8 per cent. Japan’s Topix lost 1.4 per cent, China’s CSI 300 fell 0.7 per cent and South Korea’s Kospi shed 0.9 per cent.

Ahead of the start of trading on Wall Street, US futures pointed to a gain of around 0.6 per cent for the S&P 500. On Tuesday, the S&P had closed 1.1 per cent lower in a decline that saw all of the stock market’s main sectors fall back during the day.

Big moves in US government bond yields had weighed on equities ahead of the conclusion of the latest meeting of the Federal Reserve on Wednesday, which is expected to deliver a third consecutive increase of 0.75 percentage points.

The yield on the 10-year US Treasury note reached an 11-year high of 3.6 per cent on Tuesday, while the yield on the policy-sensitive two-year note hit a 15-year high of 3.99 per cent. Both yields slipped lower on Wednesday, with the 10-year losing 0.03 percentage points to 3.55 per cent. Bond yields rise as their prices fall.

Investors will pay close attention to updated forecasts for interest rates by Fed officials — known as the “dot plot.”

The new set of projections, the first since June, will also include officials’ estimates for inflation, unemployment and growth.

John Velis, foreign exchange strategist for the Americas at BNY Mellon, said that he anticipated the Fed would raise interest rates as high as 5 per cent early next year, above the 4 per cent peak currently priced in by market.

The Fed’s new forecasts would likely imply “a sustained period of high interest rates” instead of a quick “pivot” to monetary easing early next year, said Velis.

![Mason Ramsey – Twang [Official Music Video] Mason Ramsey – Twang [Official Music Video]](https://i.ytimg.com/vi/xwe8F_AhLY0/maxresdefault.jpg)