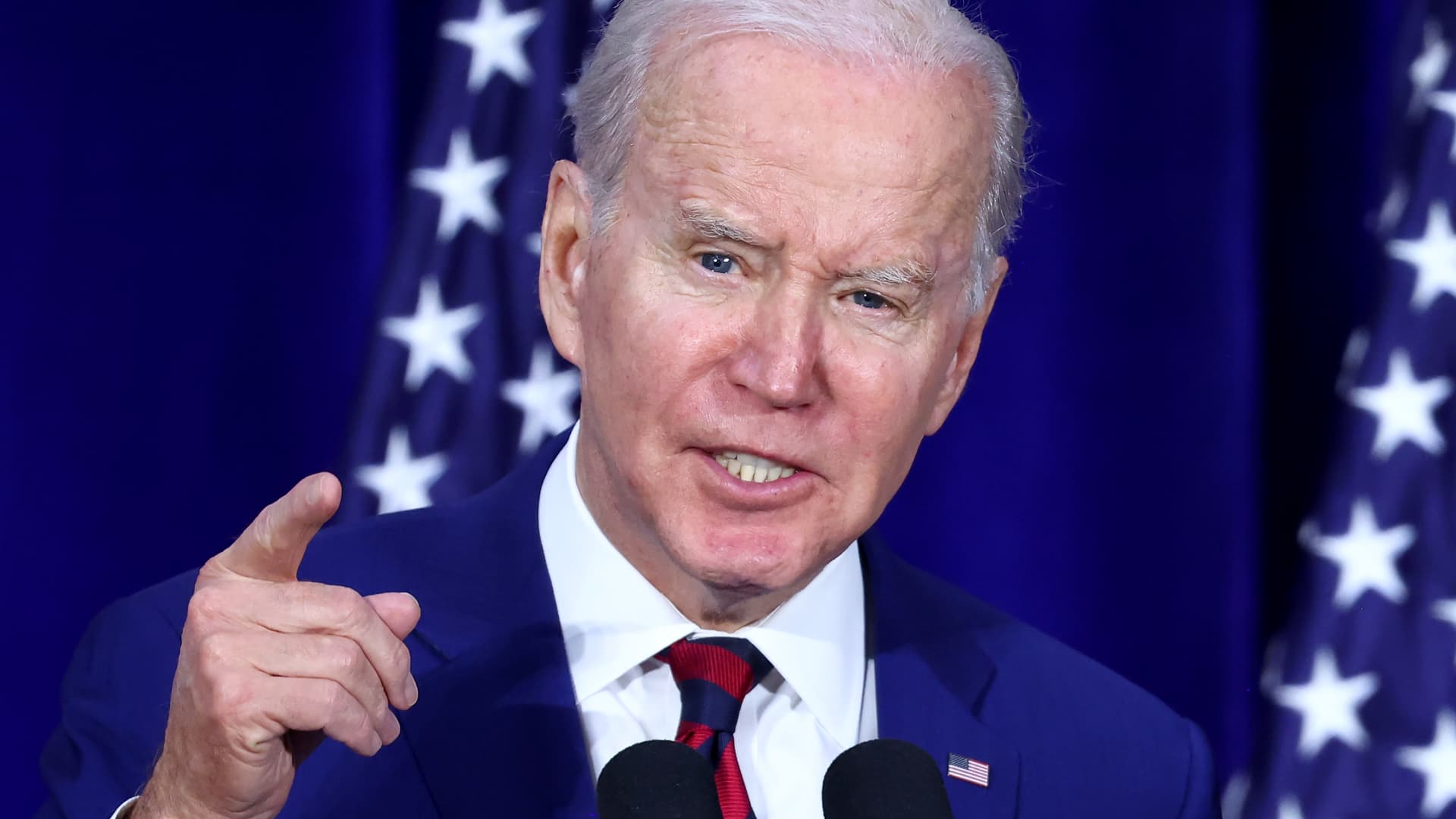

U.S. President Joe Biden delivers remarks at the Boys and Girls Club of West San Gabriel Valley on March 14, 2023 in Monterey Park, California.

Mario Tama | Getty Images

President Joe Biden called on Congress to give regulators more authority to claw back pay and penalize executives at distressed banks “whose mismanagement contributed to their institutions failing.”

“No one is above the law – and strengthening accountability is an important deterrent to prevent mismanagement in the future,” Biden said in a statement Friday. “When banks fail due to mismanagement and excessive risk taking, it should be easier for regulators to claw back compensation from executives, to impose civil penalties, and to ban executives from working in the banking industry again.”

related investing news

Biden noted his powers to hold executives accountable were constrained by the law and asked Congress step in.

“Congress must act to impose tougher penalties for senior bank executives whose mismanagement contributed to their institutions failing,” Biden said.

The nation’s top bank regulators on Sunday announced the Federal Deposit Insurance Corp. and Federal Reserve would fully cover deposits at both failed banks, Silicon Valley Bank and Signature Bank, and rely on Wall Street and large financial institutions — not taxpayers — to foot the bill. Signature Bank in New York, which was shuttered Sunday over similar systemic contagion fears as SVB, had been a popular funding source for cryptocurrency companies.

The president stressed the actions taken over the weekend were necessary to prevent further economic fallout but did not use taxpayer funds.

“Our banking system is more resilient and stable today because of the actions we took,” Biden said. “On Monday morning, I told the American people and American businesses that they should feel confident that their deposits will be there if and when they need them. That continues to be the case. “

![Mason Ramsey – Twang [Official Music Video] Mason Ramsey – Twang [Official Music Video]](https://i.ytimg.com/vi/xwe8F_AhLY0/maxresdefault.jpg)