Australia’s first battery-grade lithium refinery, the largest outside China, has opened talks with electric vehicle makers as it seeks to meet surging demand from global automakers for the mineral.

Tianqi Lithium Energy Australia, jointly owned by Chinese group Tianqi and Australian company IGO, said it was aiming to supply a number of global automakers with lithium hydroxide from its plant in Kwinana, near Perth, Western Australia. Lithium hydroxide is the refined product used in electric vehicle batteries.

“I think it’s a matter of time,” said Raj Surendran, chief operating officer of the joint venture that owns the plant, about supplying lithium hydroxide directly to electric vehicle companies rather than exporting the raw mineral to be refined in China.

He did not give further details of the talks. But he said that the Kwinana plant’s production could quadruple in the coming years.

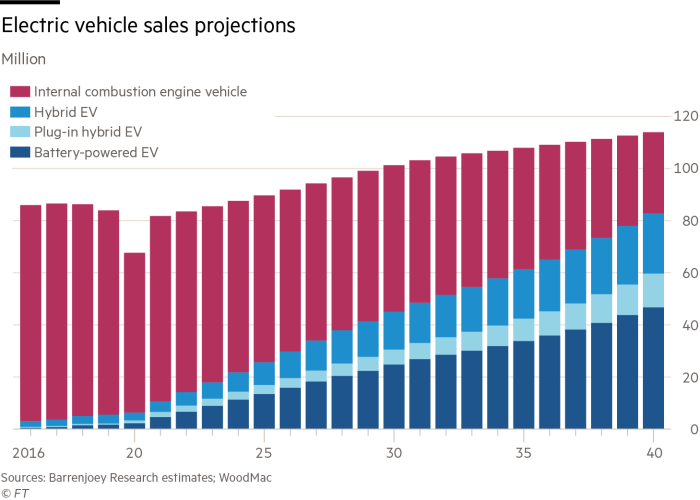

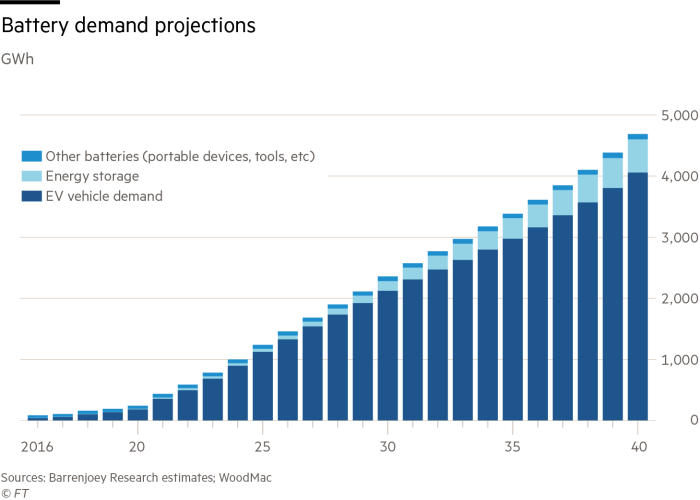

Global lithium supply is expected to triple in the next nine years, according to investment bank Barrenjoey, but that still will not be enough to match the needs of the electric vehicle market.

Even though it is majority owned by a Chinese company, TLEA is seen as important to realising a push to access supplies of refined minerals outside China, which dominates the market. Automakers in Europe and Japan are expected to be important customers of the refinery.

Carmakers, including Ford, Tesla and their Japanese rivals, are already signing deals with other Western Australian miners including BHP, Wesfarmers, Liontown and Lynas to secure raw materials such as nickel and lithium that are critical for electric vehicles.

Hayden Bairstow, head of resources research at Macquarie, said demand for lithium hydroxide was driving partnerships to transform Western Australia into the centre of the industry outside China.

“People are desperate to get hold of it but a lot of the knowledge is in China, so joint ventures like Tianqi [and] IGO are happening,” he said. “This is the first big buildout of hydroxide capacity anywhere else on the planet. It is still in its infancy but within a decade, it will be a substantial and important region for everyone’s supply chain.”

TLEA said it has taken A$1bn (US$687mn) of investment to produce lithium that is pure enough for use in batteries. Erik Laurent, general manager of the plant, described it as refining the equivalent of “a teaspoon of water from a backyard swimming pool”.

Tianqi started building the refinery six years ago when Sino-Australian tensions — which have become elevated since the start of the Covid-19 pandemic — were much lower.

The project was beset by problems and delays. Tianqi, which is listed in Shenzhen and also floated in Hong Kong this year, once fully owned the refinery and the mine.

But the indebted Chinese company found itself on the brink of bankruptcy two years ago when the lithium price collapsed. It also became embroiled in a bitter dispute with its construction contractor.

IGO bought into the refinery and Tianqi’s Australian hard-rock lithium mine in 2020 in a $1.4bn deal for a 49 per cent stake.

Peter Bradford, chief executive of IGO, told the Diggers and Dealers conference in Kalgoorlie, Western Australia, this month that the refinery was critical to his company’s push into the booming lithium market.

“I’m confident that now we have the recipe right, we can stop the focus on quality and move the focus to quantity,” he said of the refinery’s output.

Grey-coloured spodumene, a lithium ore, is refined in Kwinana by heating it in rotary kilns at 1,100C and using sulphuric acid to separate other components — including gypsum and sodium sulphate, which is used for detergent — from the core product. The white powder, the consistency of refined sugar, is then packed into 450kg bags which, at current prices, are worth A$28,000 each.

The refinery is fed by the Greenbushes mine 250km south of Kwinana, which exports spodumene to China. The mine, which is jointly owned by Tianqi, IGO and US company Albemarle, is set to almost double its output to 2.2mn tonnes by 2027.

Albemarle is planning to build a separate refinery alongside a local company, Mineral Resources, that will also be supplied by Greenbushes.

Some worry about the political risk of the TLEA refinery, given China-Australia tensions. The Chinese influence is still apparent in Kwinana. Visitors are greeted by two giant marble Chinese lion statues at the door, while the foyer is festooned with a large frieze of pandas at play. The Chinese ambassador to Australia visited the plant in June

But Surendran said the business operates independently of its majority owner and has its own board. He said Tianqi has not been “heavy-handed” in its approach to the Australia-based business.

Susan Zou, senior metals analyst with Rystad Energy, said the investment in jobs and high value-added lithium products was beneficial to the Australian market.

“These factors, as well as the existing joint venture and collaboration with local partners, help to mitigate any political risks,” she said of the refinery.