Estee Lauder (EL) reported a stronger-than-expected second quarter for its fiscal 2023 on Thursday. But shares are down on a weaker view of the next quarter, as sellers focus too much on the near term and not enough on the nascent post-lockdown recovery in China. Revenue fell about 16.5% year-over-year, to $4.621 billion, beating analysts’ expectations for $4.58 billion, according to estimates compiled by Refinitiv. Earnings-per-share (EPS) fell 44% on an annual basis, to $1.69, handily beating analysts’ forecasts for $1.29 a share and management’s original guidance of $1.19 to $1.29 thanks to control on expenses and easing pressures from foreign exchange. Shares of Estee Lauder dropped about 3% mid-day Thursday but remain up around 10% for 2023. Bottom line We can’t blame anyone who wants to take profits with the stock up nearly 50% from the last time the company reported , especially after learning about a one quarter delay in the return to growth. However, those sellers are missing the bigger picture and pullbacks still represent buying opportunities. There is going to be some noise in the supply chain as Estee Lauder deals with its last quarter of pain related to Covid. But as long as there are no more lockdowns, these issues will truly be transitory, putting it back on track for strong growth in the fiscal fourth quarter and through fiscal 2024, driven by travel retail, sales in China, and skin care. And as volumes recover, we expect more margin expansion from the company. Skin care is a high-margin category and represents the biggest percentage of the beauty business in China. We are increasing our price target to $300 from $265. Quarterly commentary Skin care sales were held back by Covid-related impacts such as limited retail traffic in mainland China and tightening of inventory by some retailers in Asia travel retail. Lower replenishment orders in the United States also negatively impacted growth. Makeup net sales also fell due to Covid affecting travel retail and China as well, but the ongoing recovery in other markets partially offset some of the declines. Fragrance was up in every region, driven primarily by growth from Estee Lauder, Le Labo, and Tom Ford Beauty. In November, Estee Lauder announced it was buying the Tom Ford Brand for $2.8 billion. We’ve liked the deal for a couple reasons: It retains ownership of a fast-growing luxury brand, and it will no longer have to make royalty payments to sell Tom Ford’s beauty products. And Hair Care sales were up thanks to growth from The Ordinary and Aveda. One geographic point to highlight: Organic sales fell 3% in the Americas, and some of that weakness may have to do with the U.S. The company has lost some share in the region, but we’re encouraged with the future based on how it saw revenue trends accelerate every month in the quarter, from October to November and then in December. Outlook Estee Lauder’s guidance for the next quarter is making some investors cautious today. Management said it expects its organic sales to decline 8% to10% versus estimates of 5% growth and adjusted earnings per share in the range of $0.37 to $0.47 versus estimates of $1.78. There is always a degree of conservatism when Estee Lauder makes a forecast — it just beat the second-quarter guide by $0.40 per share — but the main difference between what the company forecasts and the Street expects is due to pressure on the travel retail business. In November and December, the company said there were disruptions to travel and staffing levels in Chinese province Hainan that slowed the expected normalization of inventory. Tourism in Hainan has started to bounce back, but the problem is that stores were closed for so long that retailer inventory remains high. However, management said on the conference call that inventory is “almost” at a level where sales should start to accelerate. Another issue in the quarter was from the potential roll back of Covid-related supportive measures in Korea duty free. There is some uncertainty about when Korea will reopen, but these are transitory issues that shouldn’t last long. If you only focus on these negatives, you’ll miss the great story management shared about the recovery in international travel by Chinese consumers, the strong performance across many developed markets in Western Europe and Asia Pacific, and the positive benefits of a weaker U.S. dollar. It is disappointing to learn these transitory factors will cause Estee Lauder to return to growth one quarter later than anticipated. But broader confidence in the China and travel retail recovery shouldn’t derail the stock by much. (Jim Cramer’s Charitable Trust is long EL. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

An Estee Lauder pop-up store is seen inside daimaru Department Store on Nanjing Road Pedestrian street in Shanghai, China, August 6, 2021.

Costfoto | Future Publishing | Getty Images

Estee Lauder (EL) reported a stronger-than-expected second quarter for its fiscal 2023 on Thursday. But shares are down on a weaker view of the next quarter, as sellers focus too much on the near term and not enough on the nascent post-lockdown recovery in China.

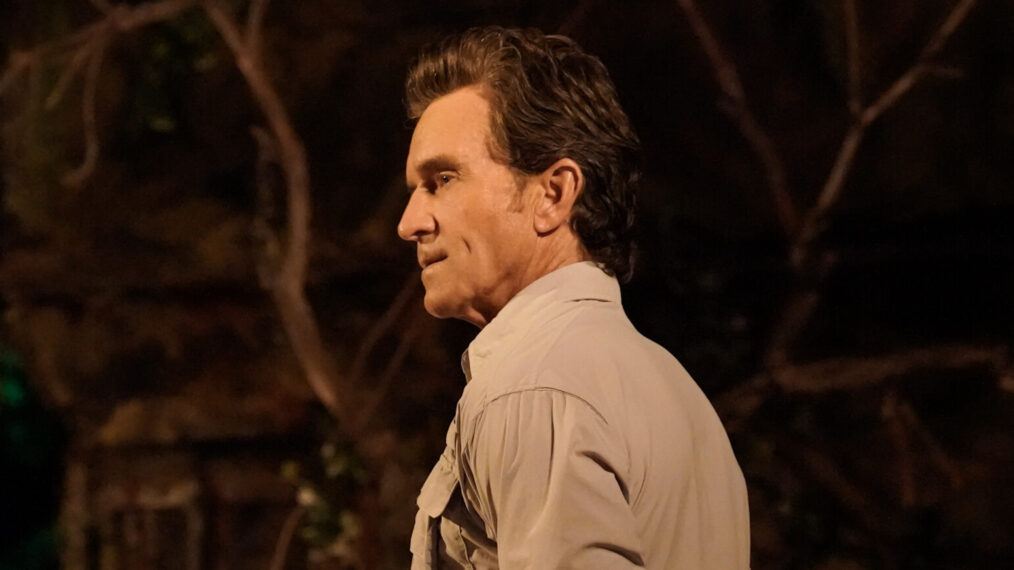

![‘Chicago Med’ Recap Season 10, Episode 8 — [Spoiler] Dead or Alive ‘Chicago Med’ Recap Season 10, Episode 8 — [Spoiler] Dead or Alive](https://tvline.com/wp-content/uploads/2024/11/chicago-med-recap.jpg?w=650)